The exemption for social security payment of foreign workers in Shanghai has expired on August 15, 2021. This means that foreign employees in the city may now be required to pay social insurance contributions, as is the case for other cities like Beijing, Tianjin, and Guangzhou.

Have a look at our previous article on Social Insurance Refund: A Takeaway Before Leaving China

After August 15, both employers and foreign employees in China may be forced to abide by the social security regulation promulgated since 2009. Find out how this will affect foreigners working in Shanghai.

Regulation on social security payment of foreigners

According to Chinese law, the collection of social insurance premiums including pension, medical insurance, work-related injury, unemployment, housing, and maternity is mandatory for Chinese employees. On the other hand, it is also supposedly enforced to foreign employees. However, the 2009 interim regulation issued by the Shanghai Municipal Bureau of Resources and Social Security stipulated that foreigners “can” contribute to the social security system, leaving it open to interpretation. Thus, in practice, most companies and foreign workers in Shanghai opted out of the social insurance payments.

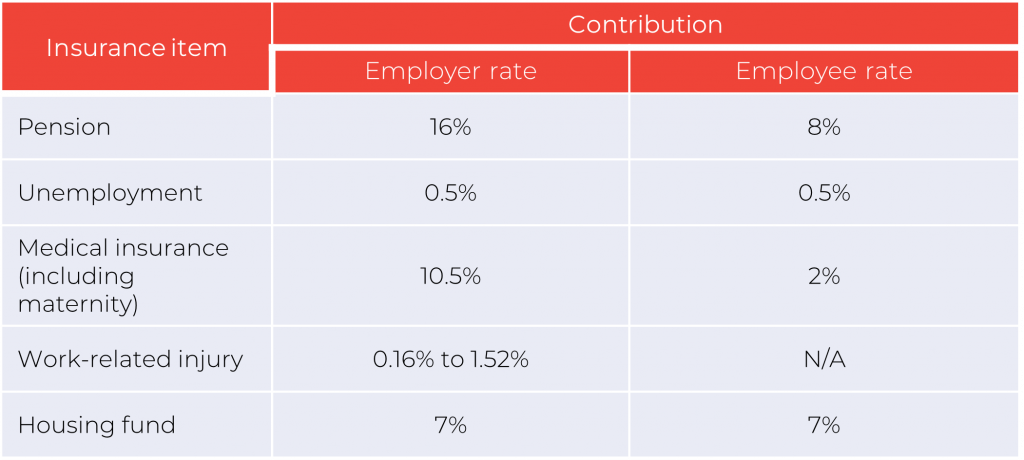

For cities which required the social security payment of foreigners, both employers and foreign workers make the contributions for pension, medical insurance, and unemployment. On the other hand, employers are required to contribute to work-related injury and maternity insurances. While housing fund is mandatory for Chinese employees, foreign employees can choose not to contribute to the housing fund scheme.

In 2011, China launched the nationwide implementation of the Social Insurance Law, reiterating the requirement for foreign employees to pay social insurances. However, there were no changes made to the Shanghai local legislation. Moreover, in 2016, the Shanghai’s social security and resources bureau announced the extension of the original 2009 notice until August 15, 2021. This means that until this mentioned date, foreign employees can still opt not to pay the said social insurances.

What’s new?

Considering that no further extension is announced for the continuation of the 2009 interim notice, it implies that foreign employees in Shanghai must follow the national law implemented in 2011. Thus, foreign workers in Shanghai may have to pay for social security including pension, unemployment, and medical insurance. On the other hand, employers in Shanghai will also cover applicable social insurance for their foreign employees.

Social security contribution rates for employers and employees in Shanghai

Sample calculation for a foreign employee earning RMB 20,000 per month (assuming it is the first time to pay for income tax):

Basic salary = RMB 20,000; social insurance = RMB 20,000*10.5%= RMB 2,100

Taxable income = RMB 20,000 – RMB 2,100 (social insurance) – RMB 5,000 (threshold) = RMB 12,900

Individual income tax = 12,900*3% – 0= RMB 387

Net pay = RMB 20,000 – 2,100 – 387= RMB 17,126

Impact of the social security requirements for foreigners

For the part of foreign workers in Shanghai, the enforced social security payment will result in salary adjustments, whereas a percentage of the social insurance is directly deducted from the gross salary. After deduction, the taxable income will be decreased. In addition, foreigners can refund in lump-sum the social insurance paid if they leave China and apply for a tax refund at the same time.

On the other hand, since the employer is also responsible for withholding the applicable social security contribution of its foreign employees, such an amount will be an additional cost to the employer.

Conclusion

It can be noted that tax authorities may be able to validate a foreign employee’s social insurance payments during the monthly tax declaration or application of tax refunds. It is important that both employers and foreign employees in Shanghai are aware of the expiration of the said exemption and assess the relevant risks if payments are not made. On the other hand, it is also best to check with tax authorities regarding the effectivity of social insurance exemptions of foreigners based on China’s tax treaties with other countries.

Furthermore, the payment of all types of social insurance by foreigners is deemed to be implemented in the future. Those who wish do business and work in China should pay attention to these foreseeable changes.

Contact Us

S.J. Grand provides advisory and support on the business set up as well as tax and accountancy services for foreign-invested companies in China. We assist foreign companies with tax optimization strategies to take advantage of China’s various preferential policies. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!