Free Trade Zones (FTZs) and Industrial Parks are designed to reduce trade barriers and attract foreign investors to China.

Key benefits for foreign companies

Free Trade Zones – economic zones that provide relaxed regulatory environment and offer the following benefits:

- Tax and duties exemptions for selected goods

- Reduced corporate income tax (CIT) (*depends on the FTZ)

- Streamlined customs clearance processes

- Supply chain advantages

- Facilitated residence permit application procedure for foreign personnel and their families

- Risk prevention systems to safeguard Intellectual Property rights

Industrial Parks – industrial clusters focused primarily on manufacturing companies grouped by industry sectors offer the following advantages:

- Investment promotion: tax exemptions, land subsidies, etc

- Favorable policy environment

- Location adjacent to an economically active city

- Support of scientific and technological innovation

- Vigorous pursuit of green and low-carbon development

- Quality living environment

A bit of background

Establishment of Industrial parks and Free Trade Zones are efforts from the Chinese government to make business within China easier and more appealing for the foreign investors.

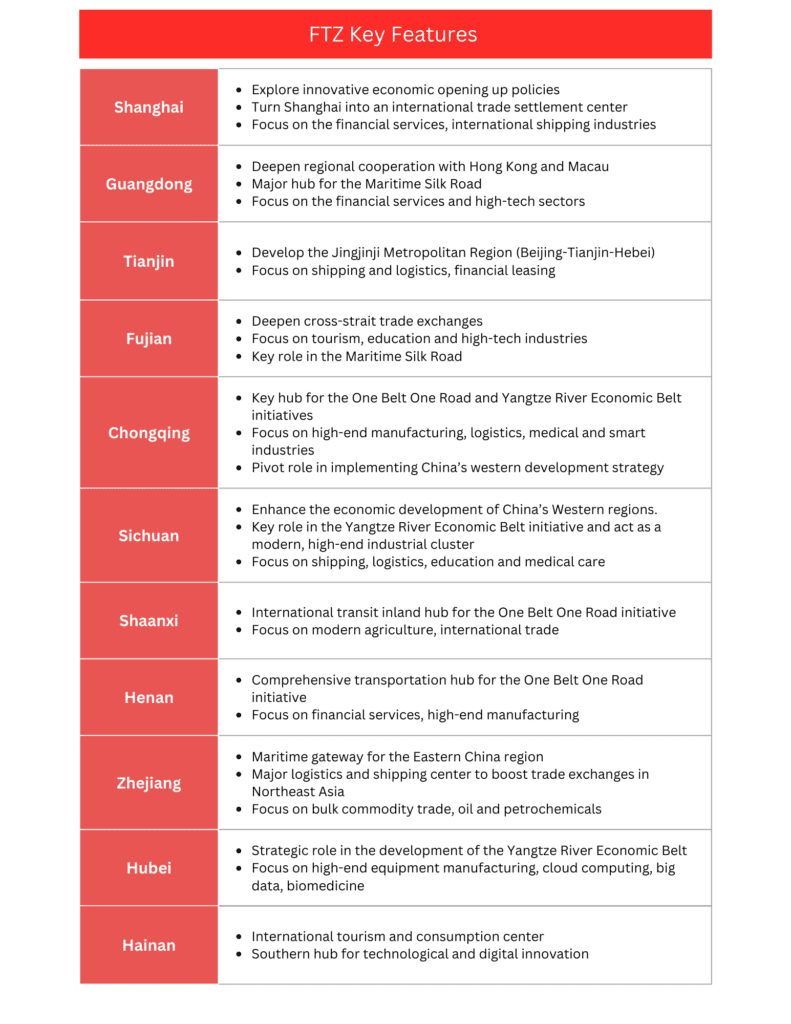

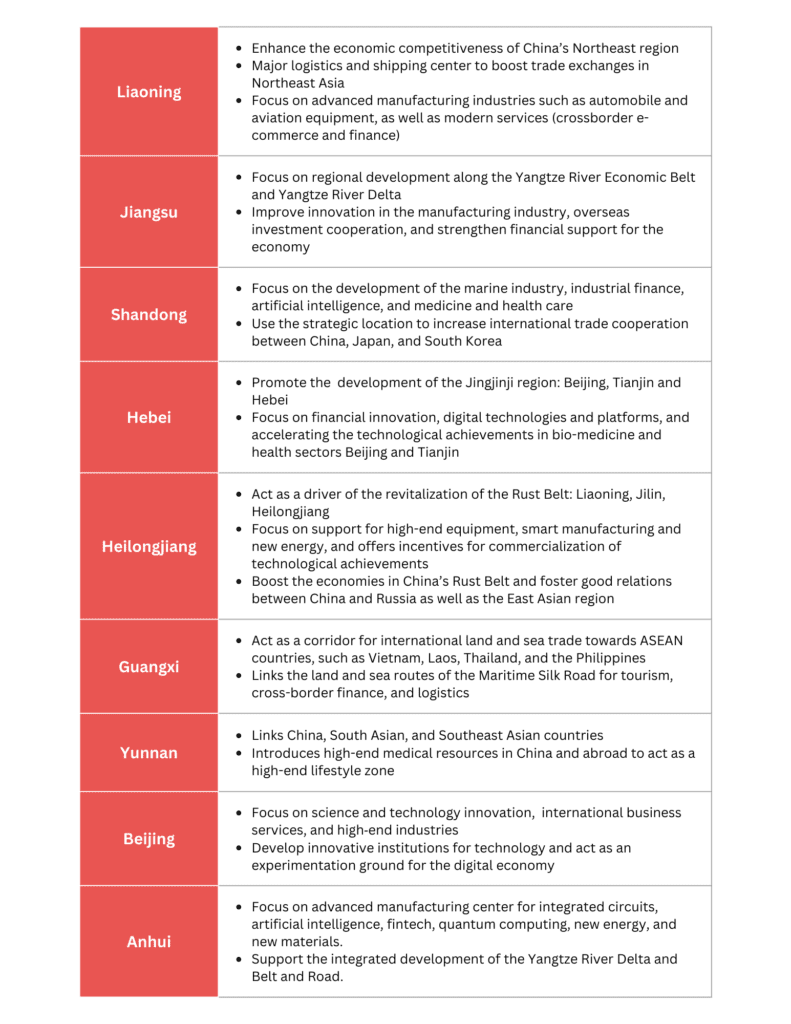

The first Chinese Free Trade Zone opened in 2013 in Shanghai. The number of FTZs has since increased to 20 FTZs and 1 FTP (Free Trade Port). Each zone is tailored to a specific industry and objective:

Industrial Parks are industry-specific areas that provide high-end infrastructure, operational and supply chain resources (spaces for R&D, warehouses, etc.). With the capacity to support both foreign and domestic businesses based in one industry, they support the innovation and development in technology, knowledge, labor, capital, etc.

Each Industrial Park specializes in a specific industry: automotives, textiles and garments, new energy vehicles (NEV), biotechnology or pharmaceuticals. Companies in Industrial Parks are often major players in their industry; for example, Panasonic, Adidas, and RadiciGroup are all companies across different industries that operate within Suzhou Industrial Park for marketing, R&D, and manufacturing purposes.

Incorporating an entity in the FTZ or locating production or an R&D facility in one of the Industrial Parks can help your business grow in a favorable regulative environment, enjoy governmental and avoid certain investment barriers.

S.J. Grand Financial and Tax Advisory assists foreign firms in navigating the complexities of China investments since 2003. Contact our experts for more information and support:

S.J. Grand is a full-service accounting firm focused on serving foreign-invested enterprises in Greater China since 2003. We help our clients improve performance, value creation and long-term growth.

Other Articles:

- Strategic Tax Optimization for Foreign Subsidiaries in China

- The Unmasking: How Chinese Manufacturers Are Challenging Western Luxury Brands

- Why Chinese Suppliers Should Maintain Long-Term Confidence

- Trump’s Tariff Moratorium: A Game of Chicken with Chinese Characteristics

- How I Learned to Stop Worrying and Love the Trump Tariffs: China’s Silver Lining Playbook