Due diligence in M&A enables companies to make a transaction from an informed standpoint. Statistically, cross-border transactions in China, where the buyer is a foreign entity, have a low success rate. The deal failure is rarely a bad thing: it means that the risks were too high or impossible to mitigate. Due to China-specific challenges buy-side M&A due diligence gains extra importance: it helps reduce risks associated with regulatory compliance, financial discrepancies, and legal issues specific to Chinese market practices.

Types of Due Diligence

Due diligence during an equity acquisition is executed to help accurately value assets, assess potential risks and the financial health of the target company, and ensure compatibility and integration post-acquisition.

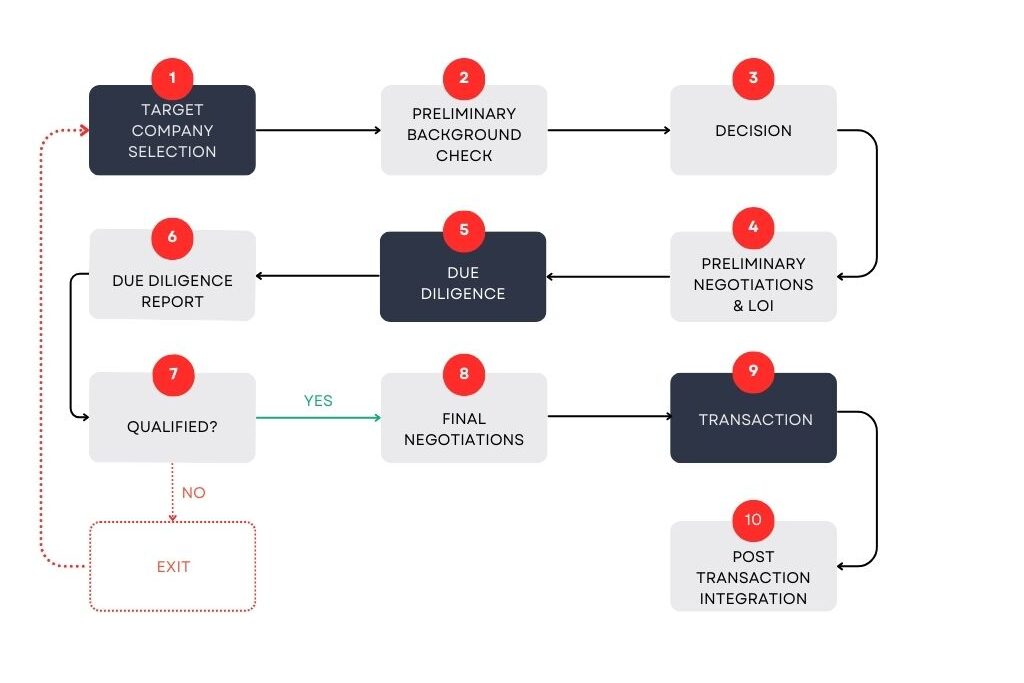

An acquisition due diligence process starts after the parties go through preliminary discussions, sign a Non-disclosure Agreement (NDA), and finalize a Letter of Intent (LOI) or a Memorandum of Understanding (MOU) outlining the desire of both sides to initiate the transaction.

Basic due diligence investigates legal, financial, and fiscal matters. However, we recommend performing the most comprehensive review possible. The devil is in the details: a deal that dies during the due diligence stage almost always dies for the right reasons.

Different due diligence areas:

- Financial Due Diligence reviews financial statements, cash flows, profitability, and financial health to prevent the acquisition of companies with hidden financial liabilities or unsustainable financial practices.

- Legal Due Diligence examines the corporate structure, legal compliance, intellectual property (IP) protection (patents, trademarks, etc.), contracts, and potential legal liabilities to reduce the risk of future litigation or compliance issues, safeguard the investment, and confirm the security of IP assets.

- Real Estate and Fixed Assets Due Diligence reviews real estate holdings, leases, and the condition of physical assets to provide accurate valuation and understanding of asset conditions.

- Environmental Compliance Due Diligence assesses compliance with local environmental laws and regulations to ensure compliance and avoid costly penalties in the future.

- Commercial Due Diligence assesses market positioning, competitive landscape, and customer base to avoid overestimating market potential and ensure accurate forecasting of revenue streams.

- Operational Due Diligence assesses operational efficiencies, production capabilities, supply chain robustness, inventory management, and regulatory compliance to identify inefficiencies or operational risks that could impact productivity and profitability.

- IT Due Diligence evaluates IT infrastructure, cybersecurity measures, and system integration capabilities to avoid integration issues and potential cybersecurity vulnerabilities.

- Human Resources Due Diligence reviews the organizational structure, compensation structure, social security contributions payments, employee contracts, and internal HR procedures to ensure compliance with labor laws and determine if the human capital aligns with the buyer’s strategic objectives.

A comprehensive due diligence is necessary for the valuation, an assessment of the acquisition potential, and future integration.

China pitfalls – The cost of compliance

The foreign owner might have higher expenses after the transaction is finalized. Often, there are some issues with reporting, wages or rent paid under the table, underpaid corporate income tax (CAT), failure to file for a registration or license, etc., all to save costs. A change in ownership will trigger a review from the authorities. Thus, if the foreign investor wants to proceed with the acquisition, all the compliance-related issues must be resolved.

In these cases, it often does not make sense to go through with the transaction.

One of the most common examples of post-acquisition cost rise is the wages paid in cash. In this scenario, employees get paid off the record (partly or fully) to avoid taxes. If a foreign buyer goes forward with the transaction getting all the employees on formal payroll would mean an increase in cost per employee. You will not only need to start paying the employer part in taxes and contributions, but the employee will have to start to pay taxes as well and, as a result, will demand a raise in gross salary.

Entering a JV

The risk of entering a Sino-Foreign joint venture deserves a separate article. Misrepresented financial health, intellectual property theft, and abuse of authority by the local partner are some risks associated with a China JV. Due diligence is the tool that helps you protect your investment and make sure your businesses are compatible.

Acquisitions and JVs are not always workable ways to enter a new market.

China Due Diligence Tips

- Employ experts

The most important advice is to employ experts. You will require professional help from an accountant and a lawyer to execute financial and legal due diligence. Your accountant should have China’s due diligence experience to look through the books, identify red flags, give you an estimate for the compliant business operations costs, and frankly let you know if the deal makes sense.

The contracts and agreements must be reviewed by a lawyer from an international and a local perspective.

- Background checks

If you plan to keep the key employees, you might want to run background checks. Also, you might want to do the same for the potential suppliers.

- Joint venture due diligence

Focuses on the prospective partner’s finances, operational model, capabilities, and potential legal risks.

Invest in China Safely

Buy-side M&A due diligence in China is indispensable for managing risks, ensuring compliance, understanding local market dynamics, and making informed investment decisions.

Navigating buy-side and sell-side M&A transactions in China requires expertise and a profound understanding of local business practices. For professional advice on China M&A, joint venture entry, and to explore alternative options – reach out to our experts at contact@sjgrand.cn.