Each year, the State Taxation Administration issues updated guidelines on tax filing and payment deadlines, ensuring clarity for monthly, quarterly, and annual obligations. On December 10, 2025, the State Taxation Administration issued the Circular of the General Office of the State Taxation Administration on the Tax Filing and Payment Deadlines for 2026. The circular clarifies the deadlines for taxpayers required to complete tax filing and payment within 15 business days after the end of each month or quarter.

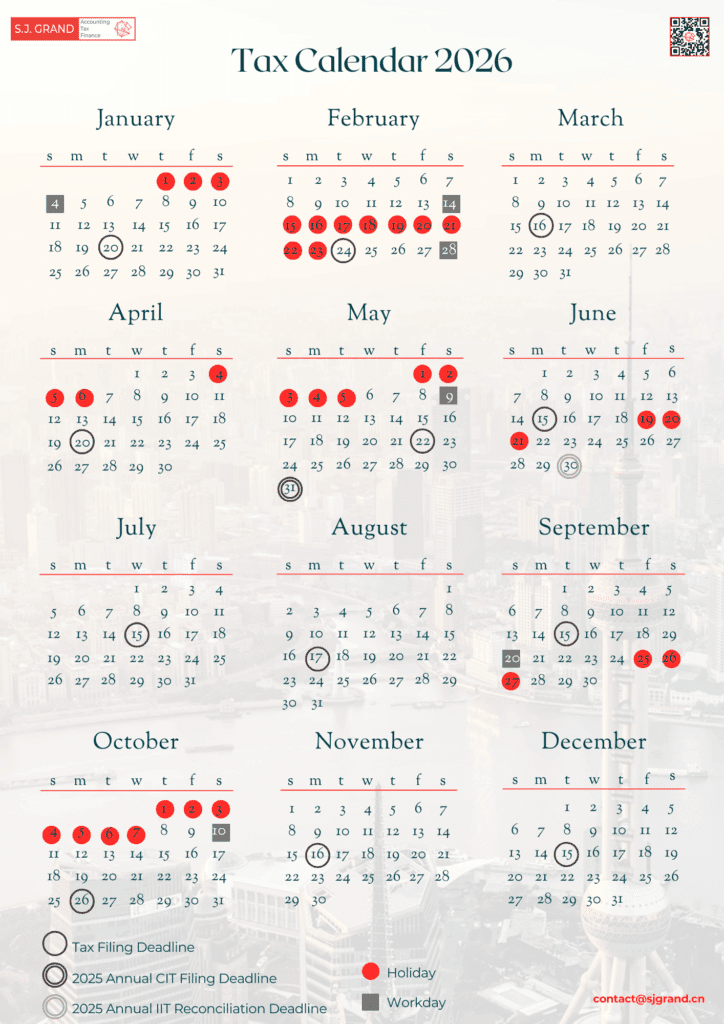

Tax Filing Deadlines 2026

Standard deadlines: For June, July, September, and December, the filing deadline remains the 15th of each month.

Adjusted deadlines due to holidays:

- January: Extended to January 20 due to the New Year holiday (January 1–3).

- February: Extended to February 24 due to the Spring Festival holiday (February 15–23).

- March: Extended to March 16 as March 15 falls on a Sunday.

- April: Extended to April 20 due to the Qingming Festival holiday (April 4–6).

- May: Extended to May 22 due to the Labor Day holiday (May 1–5).

- August: Extended to August 17 as August 15 falls on a Saturday.

- October: Extended to October 26 due to the National Day holiday (October 1–7).

- November: Extended to November 16 as November 15 falls on a Sunday.

Special circumstances: If any entity needs to adjust its filing deadline, it must report to the State Taxation Administration (Department of Tax Collection and Technology Development).

General rules:

- Monthly and quarterly tax filings are typically due within 15 days after the end of each period, with extensions when deadlines overlap with official holidays.

- Annual Corporate Income Tax (CIT): Filing and reconciliation for 2025 must be completed by May 31, 2026.

- Annual Individual Income Tax (IIT) reconciliation: Applies to resident taxpayers (including foreigners) on comprehensive income (wages, labor service remuneration, author’s remuneration, royalties). The reconciliation period runs from March 1 to June 30 each year.

For your convenience, we have prepared a 2026 visual calendar highlighting bank holidays, adjusted workdays, and tax filing deadlines.

Looking for more than just tax deadlines?

We provide tailored compliance solutions to keep your business fully aligned with China’s regulatory requirements. We also offer corporate compliance health check – a comprehensive review of your company’s compliance posture and potential risks. From tax planning strategies to regulatory compliance consulting and process optimization, our experts help you minimize risks and maintain a strong standing.

Contact us today to find out more about China taxes, schedule your corporate health check and build a customized compliance roadmap for 2026.

Latest Articles: