Explaining taxes has always been a challenging topic for those who live and work in China. The reforms made in 2019 concerning the new IIT law resulted in monthly tax variation which may not be easily comprehensible to some.

Have a look at our previous article on China Adopts a Revised Individual Income Tax Law

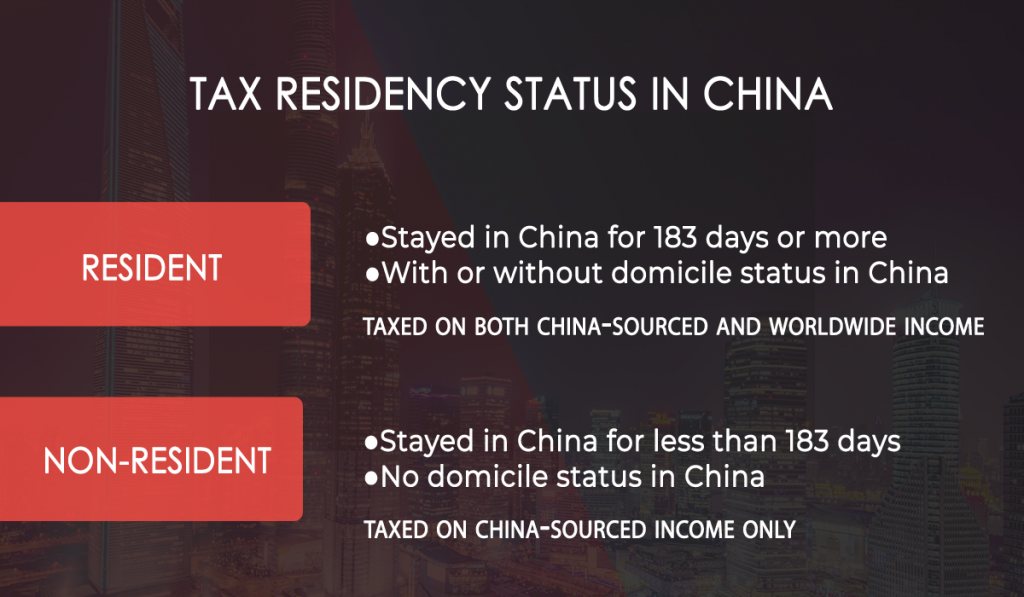

China’s changing taxable rates lie in the withholding method stipulated by the new law. Moreover, your tax liability also now depends on whether you are a resident or non-resident taxpayer in China. Keep reading to learn more!

What is the difference between resident and non-resident taxpayers?

Foreigners cannot be domiciled unless they reside in China due to household registration, family ties, and economic involvement. In practice, all PRC nationals are treated as tax residents in China unless they immigrate.

If you are a resident taxpayer with no domicile status, you can be exempted from paying worldwide income tax if you have stayed in China for less than six years. On the other hand, if you are a non-resident taxpayer, you can be subjected to worldwide income tax if you have stayed in China after six years without leaving the country for thirty days.

To be exempted from paying worldwide income, you must leave China for 30 consecutive days or more during one calendar year (considered as one tax year) within the six-year period, according to the new six-year rule. If there is a single departure outside Mainland China for 30 days or more, the calculation of six years will restart in the next tax year.

How does the monthly tax rate variation affect the taxpayer’s gross salary?

The new cumulative tax withholding method is one of the major changes in China’s IIT law. According to this method, the monthly IIT deductions will be based on the annual income. This means that domiciled, resident employees will have a higher net salary in the first few months of the tax year and will then be lower towards the end of the year.

Since the new IIT declaration procedure has been implemented from January 2019 and the monthly declaration is now done on a cumulative basis, the monthly net salary and IIT will vary.

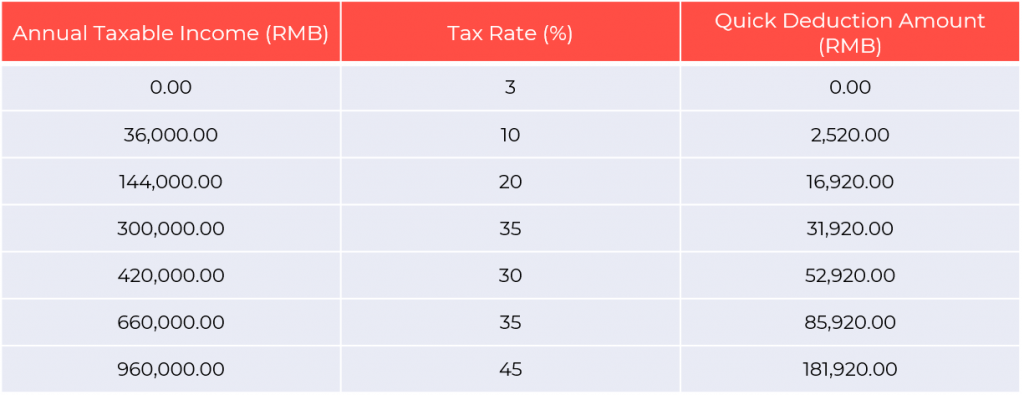

The new IIT also showed various changes to individual tax brackets where the lower tax brackets have been expanded, the middle brackets have been narrowed and the higher bracket maintained. This only means that more taxpayers in the lower brackets can have access to lower IIT rates and tax cuts. The table below shows the tax rate changes in China’s IIT.

The monthly tax variation depends on changes in the accumulative income of taxpayers which leads to changes in their tax rates as well. One big factor affecting the accumulative income is the special itemized deductions introduced by the new IIT law.

If a foreign employee decides to apply the special itemized deductions for a certain month, his or her accumulative income will increase, thus, the tax rate also increases.

How to apply for special itemized deductions?

Specialized itemized deductions apply to both Chinese and foreign employees. They can apply for tax exemptions or deductions on the following set of items:- Education of the children

- Continued education

- Treatments for serious illnesses

- Property mortgage interest

- Housing Rents

- Care for the elderly

- Download the tax APP and report accurately.

- Authorize a representative firm for the reporting and registration.

How to calculate tax on the year-end bonus?

To calculate the taxable annual bonus, divide the year-end bonus amount by 12 months, and determine the tax rate and quick calculation deduction by the monthly average income amount.

Formula: Taxable annual bonus = one-time annual bonus x applicable tax rate – quick deductions (assuming that the individual’s monthly salary is equal or higher than the deductible income stipulated by the government)

According to STA’s Caishui (2018) No. 164, the above calculation of a one-time bonus will apply until the end of December 2021. Starting from January 1, 2022, the annual bonus will be incorporated together with the individual’s salary and will become taxable under the normal IIT rates.

When to declare individual income taxes?

Tax residents should submit annual tax filing by June 2021 for the year 2020. The annual tax filing is a way to summarize all income received during the year and make an assessment of whether all taxes have been paid.Have you read? Income Tax Self-declaration for Individual Taxpayers in ChinaForeign employees can refund overpaid taxes but underpaid taxes are due on June 30, 2021. Some situations in which an employee may have overpaid or underpaid include the following:

- With other income declared except salary such as service, royalties, author remuneration, etc.;

- Working for more than 1 employer within one fiscal year;

- With income not declared by monthly;

- With salaries income from more than 2 employers;

- Some additional deductible costs not declared monthly.

What are the tax-exempt benefits for foreigners?

Foreigners can enjoy tax exemptions or special itemized deductions as mentioned above. Both can be applied from the present until December 31, 2021. However, by December 31, 2021, such tax-exempt benefits will not be applied anymore. Thus, foreigners can only take advantage of the special itemized deductions.Read more about this on Foreigners in China: How to Qualify for a Tax ExemptionIn terms of annual bonuses, resident taxpayers can choose whether to tax it separately or add to their taxable comprehensive income. However, from January 1, 2022, the annual bonus will only apply through the latter.

Key takeaways

China’s last revision of its IIT law was way back seven years ago in 2011. Thus, the current IIT law reflects significant changes in the way tax is now treated. One of the major changes in the 183-day rule for a foreigner to be a tax resident. The old system also originally taxed three types of income at a flat rate of 20 percent. The new IIT combines these incomes and is subject to a set of progressive tax rates from 3 percent to 45 percent.Contact us

S.J. Grand’s tax and accountancy services provide advisory on China’s tax and business regulatory environment as well as assist in annual tax closing and tax simulation for foreign individual workers and enterprises in China. Contact us to get you started. If you are interested to know about our latest Cloud-based company solution, go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.