Duty exemption, or exemption from customs duties, is an encouragement for businesses to bring in (or ship out) their goods from outside countries. Due to the huge impact of foreign investment on China’s developing economy, the country has since made opportunities to attract more foreign investments. Thus, foreign investors and businesses gravitated toward China’s market despite the economic impact of COVID-19.

Take a look at our previous article on China Market Entry Guide for Potential Investors

China has implemented several preferential policies since the market access for foreign investment in the country relaxed in recent years. One of the latest policies includes duty exemption for trading goods.

New duty exemption policy for encouraged industries

Since January 27, 2021, enterprises in the list of encouraged industries benefited from the latest customs duty exemption policy. The said exemption applies to all equipment imported for direct self-use, as well as any technology, accessories, and spare parts imported under contract as regards such equipment. This provision applies depending on the total investment amount allowed for foreign investment projects, including capital development projects listed in the Encouraged Catalogue. That is, those import items that fall within that range of amount will be exempt from customs duties only if included in the said list. Moreover, import-related Value Added Tax (VAT) will still be levied on these items

Preferential policies – Catalogue of Encouraged Industries for foreign investment

The Encouraged Catalogue of Industries refers to the list of industries where foreign investments are “encouraged” as they have the potential to boost market access and economy. According to the new preferential policy, land-intensive foreign investment projects within the scope of the Encouraged Catalogue may be allowed priority land-use allocation. The price for the land usage may be fixed at 70 percent of the national minimum price for the transfer of industrial land at the same level or higher.

Eligible foreign-invested enterprises in the western region and encouraged industries in Hainan province can enjoy a reduced corporate income tax of 15 percent (previously 25 percent).

Have you read? Hainan Economy Boosted with New Duty-free Policy

Notable changes to the Catalogue (2020 Edition)

- Advanced manufacturing and supply chains: additions in areas of raw material, spare parts, and end products

- Production-oriented services: integrated development of service and manufacturing industry; upgrades or modifications in the areas of research and design development, business services, modern logistics, and information services

- Central, Western, and Northeastern Regions: an expanded list of advantageous industries for foreign investment in central and western regions to lure investment into these areas (Heilongjiang, Yunnan, Henan, Shaanxi, Guangxi, Hubei, Sichuan, Chongqing, Liaoning, Anhui, Hunan, Hainan, and other provinces)

- Enforcement of the 2020 edition, thus, the cancellation of the Catalogue (2019 Edition)

- 65 items added to the National List

- 62 items on the Regional List

- 1,235 items in total

- 88 existing items modified

It can be noted that the 2020 edition of the Encouraged Catalogue came out just a year after the previous edition, This shows significant progress in speeding up the entry of foreign investments into China. The global decline in foreign direct investments prompted the Chinese government to push for this quick update. Thus, China considers this as an important move to stabilize foreign trade and investment in the country. In the past, the government has updated the Encouraged Catalogue only once every three to five years.

Not eligible for duty exemption

Items in the said Catalogue that are not eligible for tariff exemption in foreign investment projects shall not enjoy exemption. The same applies to those listed in the Catalogue of imported major technical equipment and products that are not eligible for tariff exemption. Moreover, the customs administration will still levy related value-added tax (VT) on the said import items.Project industrial policy item code

Once the 2020 version of the Catalogue of Encouraged Foreign Investment Industries is rendered effective, the following shall be put into use:

- Catalogue of Industries for Guiding Foreign Investment Nationwide

- Items listed therein shall have a code that consists of the letters “AA” followed by a three-digit number.

- Catalogue of Priority Industries for Foreign-investment in Central and Western China

- Items listed therein shall use a code that consists of the letter “W” and a four-digit number.

This code or “The Project Industrial Policy Item Code” and the “Project Nature and Category” applicable to a relevant foreign-funded project under the “Confirmation Letter on Domestic and Foreign Investment Projects Encouraged by the State” as well as other relevant documents shall be put into use.

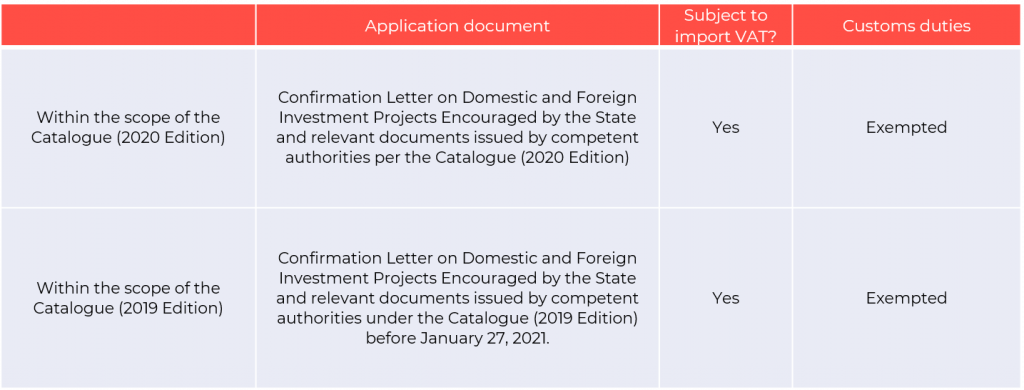

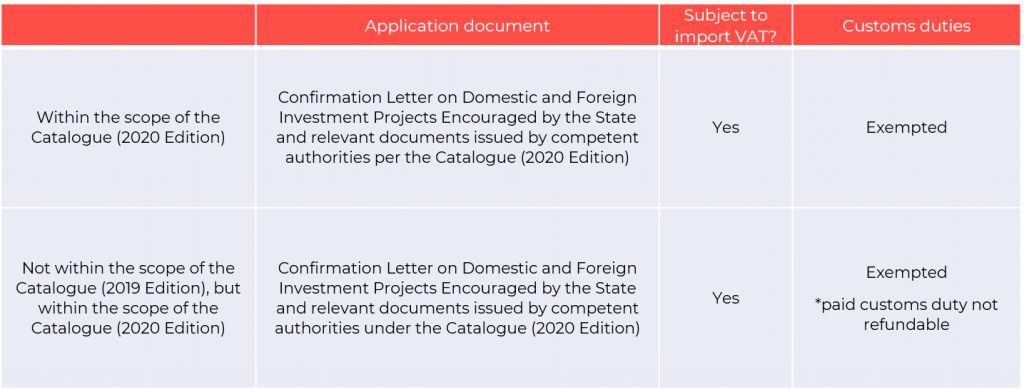

For Foreign-invested Project approval, verification, or record filing and duty exemption

- Before January 27, 2021

- On and after January 27, 2021

Conclusion

Foreign-invested enterprises continue to benefit from the ease of market access in China. To note, they contribute to one-fourth of China’s industrial output value and one-fifth of its tax revenues. On the other hand, about forty percent of the country’s total import and export volume also comes from FIEs.

In contrast to other countries that have made foreign investment more difficult due to the pandemic in 2020, China has been more determined to stabilize foreign investment, carry out reform, and open up access unlike in years prior. Moving forward, all these expansions and tax reductions, and/or exemptions provide for a more desirable economy and greater market access to foreign investment.

Contact us

S.J. Grand provides advisory and support on setting up a foreign-invested business in China. We put our competent team at your service to provide you with China market entry advice and tax optimization strategy especially for SMEs in China. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!