Small and large enterprises in China expect to gain savings from the new social insurance policy of the Chinese government. On January 30, 2020, the Ministry of Human Resources and Social Security (MHRSS) announced measures concerning social security contributions during the coronavirus outbreak.

Read our previous post on Social Insurance Cuts to Help Small Enterprises in China

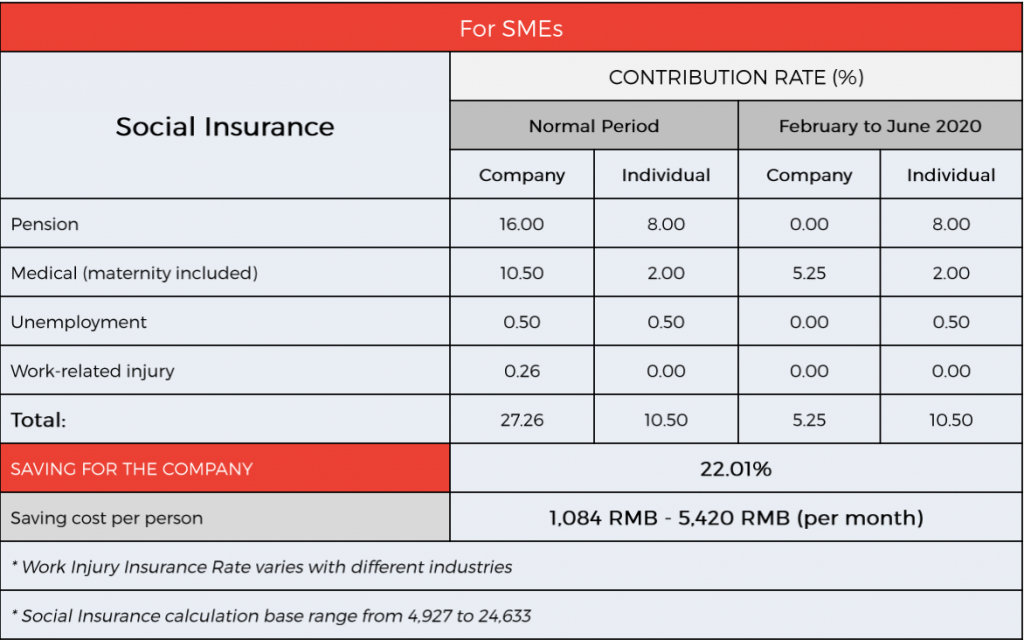

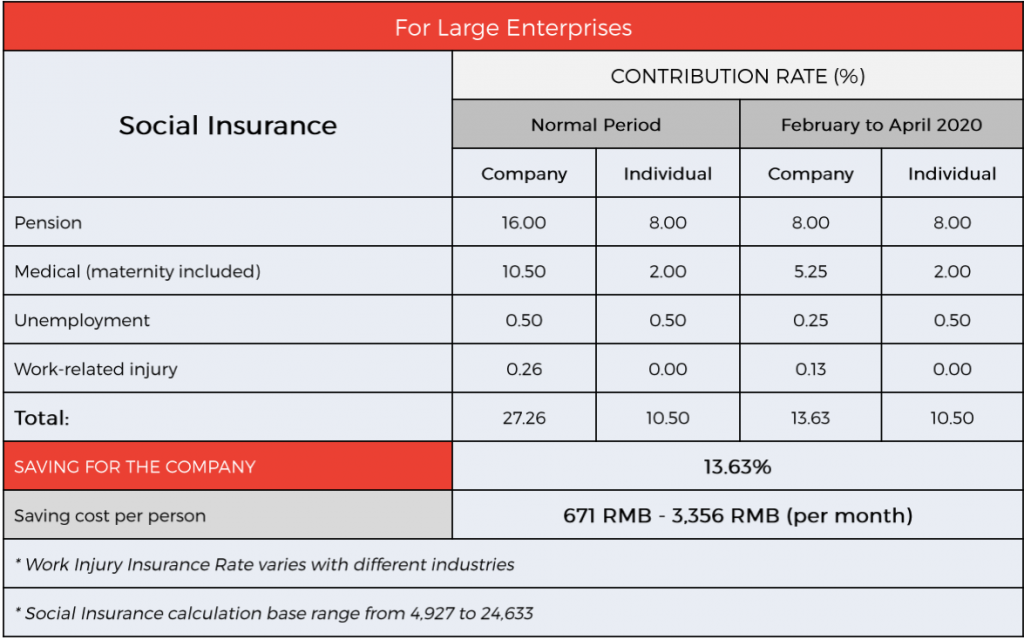

The most significant point of the policy includes waiving the three kinds of social insurance premiums including pension, unemployment and work-related insurances for enterprises in Hubei provinces and small enterprises in other cities. The reduction exemption period starts from February to June. On the other hand, large enterprises may reduce social insurance contributions by 50% from February to April 2020. Keep reading!

Local policies on social insurance exemption

Many local governments began implementing specific measures following the state policy. The details below will guide you through the new social insurance policy and how much you can save from the government’s exemption.

All cities in Hubei province

Social insurance premiums

As mentioned, the exemption period is from February to June 2020. Furthermore, social insurance payments can be deferred from July 1 to December 31, 2020. Enterprises can pay back the fund within 3 months after the end of the epidemic control and prevention in this area.

Payment on housing

The specific measures can be inquired through the official website of the Ministry of Housing and Urban Rural Development of each city.

Medical insurance

If the government has sufficient medical insurance funds during the 6 months of the deferred payment period, the enterprise will be able to apply for the reduction of its medical insurance by 50%.

Other cities

Social insurance premiums

The reduced social rates vary for each city or province. For example, in Beijing, the pension rate is reduced from 16% to 8% while the unemployment insurance is adjusted from 0.8% to 0.4% from February to April 2020. Furthermore, the work-related injury insurance is cut by half the current rate for the same period. These rates apply to large enterprises in Beijing. On the other hand, small and medium-sized enterprises are exempted from paying these three kinds of social insurances.

Enterprises are advised to call 12333 hotline to get the more specific implementation for respective cities or provinces.

Payment on housing

The deferred payment period for most cities started from February to June or before June 30. However, some cities like Tianjin, Jiangxi, and Sichuan started from January to June. On the other hand, Hainan extended its period from January to July.

Meanwhile, Shanxi specified its deferred payment period from January to 3 months after the epidemic. For loans with a time limit, payment is extended to two months after the epidemic and there will be no penalty or overdue payments to be made.

Medical insurance

Medical insurance including maternity in most cities can be reduced by half depending on the sufficiency of government funds during the 6 months deferred payment period.

Sample calculation of savings for enterprises

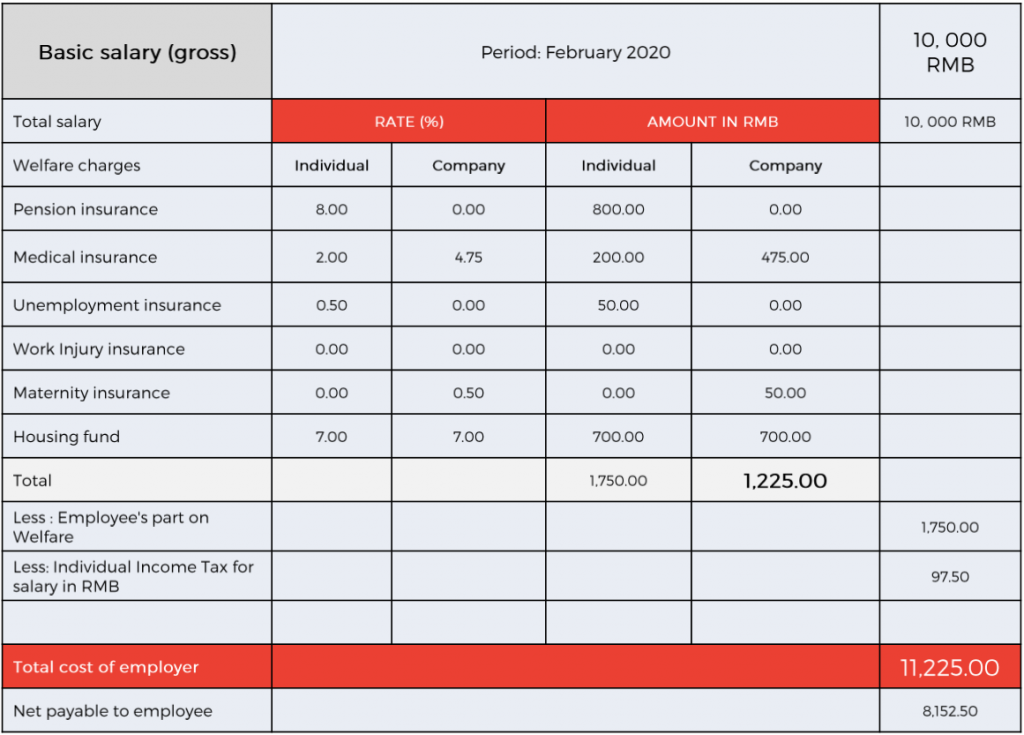

Below is a sample calculation of the social insurance cuts in Shanghai city. It is based on the work-related injury insurance rates for the consulting industry.

Savings for SMEs

Savings for large enterprises

Sample of payslip calculation for an employee with 10,000 RMB basic monthly salary.

Key takeaways

The updated social insurance policy during the COVID-19 epidemic will not have an adverse impact on employees’ rights to social security benefits. Furthermore, local authorities also provide a payment extension for a maximum of 6 months for enterprises with difficulty in production and operation. At the same time, they will not impose penalties for extended payments.

Moreover, according to the updates on China’s social security policy, employees that could not pay their employees’ wages, unable to operate for more than 3 months, or could only pay for basic living expenses for their employees may apply for an extension of not more than a year.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!