China is ramping up support for foreign-invested enterprises with plans to further reduce the “Negative List” of industries for foreign investment. The country has also started soliciting public opinions for the revision of its catalogue of industries related to tax exemption on trade.

Read our previous article on Export Enterprises to Benefit from Increased Tax Rebates

China’s New Foreign Investment Law (FIL) mandates that the country’s Negative List will be revised each year to further remove restrictions for foreign companies in China. Read to learn more about it.

What is a Negative List?

A Negative List refers to limitations given to foreign investments entering a certain country. As the term implies, it is a list of industries in which foreign companies are prohibited or restricted to invest unless relaxed measures are set out.

China first introduced its Negative List in 2013 related to the Shanghai Free Trade Zone. It was established as China’s Pilot Free Trade Zone to enable the corporate establishment and financial trade in the integrated areas within the city. Eventually, the country expanded its economic opening-up in other provinces such as Guangdong, Tianjin, Fujian, Chongqing, Hubei, and Sichuan.

On January 1, 2020, the National People’s Congress of China passed and implemented a new Foreign Investment Law. It aims to ensure the equal domestic treatment to foreign companies not covered in the Negative List. It also promises protection for investments under intellectual property rights (IPR).

Revised Negative List of Industries

Since June 30, 2019, the China Development and Reform Commission of the Ministry of Commerce has implemented two negative lists for foreign investment access. Moreover, it also issued the “encouraged catalogue” of industries that took effect in the same period.

With the revised negative lists, China has further relaxed foreign investment access to several industries (See: 2019 FI Negative List Edition). From 48 in 2018, it has cut the list down to 40. It also reduced the negative list for the pilot free trade zone (See: 2019 FTZ Negative List Edition) from 45 in 2018 down to 37 last year.

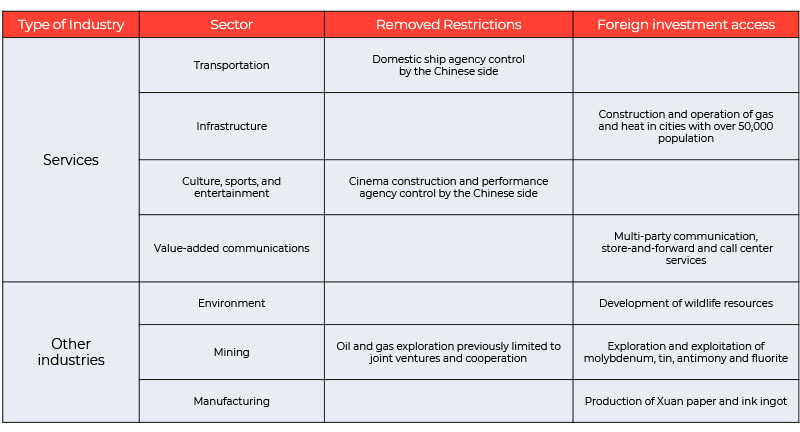

The following are the details of the revision:

- Previously, the commerce ministry limited the foreign shares on the value-added communications category to 50%.

- Xuan paper is a kind of rice paper that originated in ancient China used for writing and painting. Ink ingot is Chinese ink sticks used for calligraphy and brush painting.

New Catalogue of Encouraged Industries

The Encouraged Catalogue of Industries entails foreign participation in industries deemed crucial for economic growth. The “catalogue” was first issued in 1995 and then revised in 2015 and 2017 to further attract foreign investments. The 2017 Edition aimed at relaxing restrictions on foreign investment and operations in the Chinese services, mining, and manufacturing sectors.

In 2019, the government once again amended the catalogue to consist of sub-catalogues.

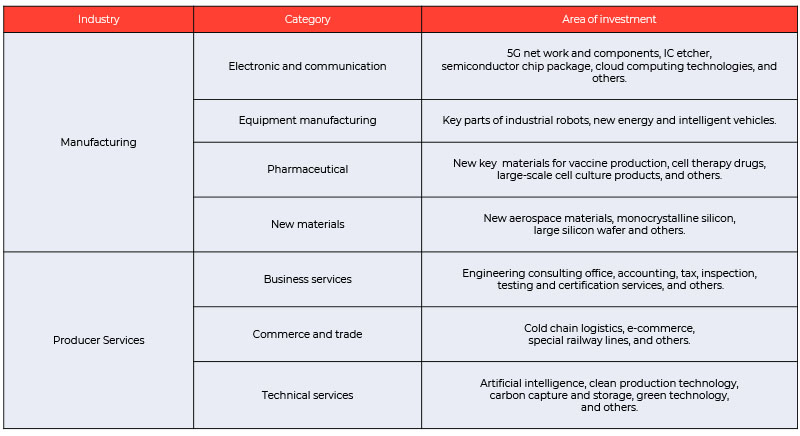

National Catalogue (for the whole country)

- Focused on advantageous industries

- Number of industries: From 348 to 415 ( 67 added, 45 revised)

- 80% accounts for the manufacturing industry

The following are the details of the revised National Catalogue:

Central and Western Catalogue (for central, western and northeast regions)

- Intended to “encourage” foreign investments

- Number of industries: 693 (54 added, 165 revised)

- Transfer of foreign investments to 22 provinces

List of provinces and their advantages

Yunnan, Inner Mongolia, Hunan and other provinces

- Agricultural resources and labor

Additional or modified items in areas of agricultural product processing, textile and clothing, furniture manufacturing and others.

Anhui, Sichuan and Shaanxi and other provinces

- Electronic industry

Additional items such as general integrated circuits, tablet computers, communication terminals, and others.

Henan, Hunan, and other provinces

- Transportation and logistics network

Additional items such as material flow storage, automobile filling station, and others.

Key takeaways

The Ministry of Commerce also included fishing and printing industries in the revision of the Negative List regarding the FTZs. Besides, the Chinese government has also started soliciting for opinions for the revision of the catalogue of industries to provide support for FIEs affected by the COVID-19 outbreak. The proposal contains preferential tax treatment including a preferential corporate income tax rate of 15%.

Although the amendments regarding China’s Negative List and Encouraged Catalogue of Industries are welcomed, foreign investors should take into consideration the existence of the Negative List of Market Access intended for both domestic and foreign investments. Therefore, it is advisable to consult with local experts regarding this matter.

Contact us

Our team of local and foreign experts can assist you in matters regarding foreign investments in China. Moreover, you can take advantage of our easy-to-use, 24-hour access management tool like Kwikdroid.

Kwikdroid is a Cloud-based accounting and company solution that will be made available in your workplace in no time.

S.J. Grand also offers Cloud ERP services for your business if you are currently experiencing difficulty in managing your operations amid the COVID-19 pandemic. Check out our IT services page for more details.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!