The payroll system in China is different from the rest of the world due to its complex tax system. China’s tax system considers the local rules and regulations of every city. Thus, it is important for companies to handle these tax variations accurately. Regardless, the Chinese government makes frequent changes in policies and holiday arrangements. It also promotes stricter labor laws and imposes hefty penalties. Due to these reasons, foreign companies in China often seek help from local payroll service providers to avoid all these complications.

Have a look at our article about Work in China: A Guide to Foreign Employment

This article provides a brief understanding of why it is important to have a payroll service provider for foreign businesses in China.

What is included in China’s payroll?

Chinese payroll typically includes salary, taxes, and social contributions. In China, social contributions differ from city to city. For the employer’s part, the rate of social contribution is also based on the city where it is registered. Moreover, the tax authorities calculate the individual income tax based on an annual accumulative basis. This makes it difficult to come up with an estimate. Therefore, it is best to get a professional service with local expertise.

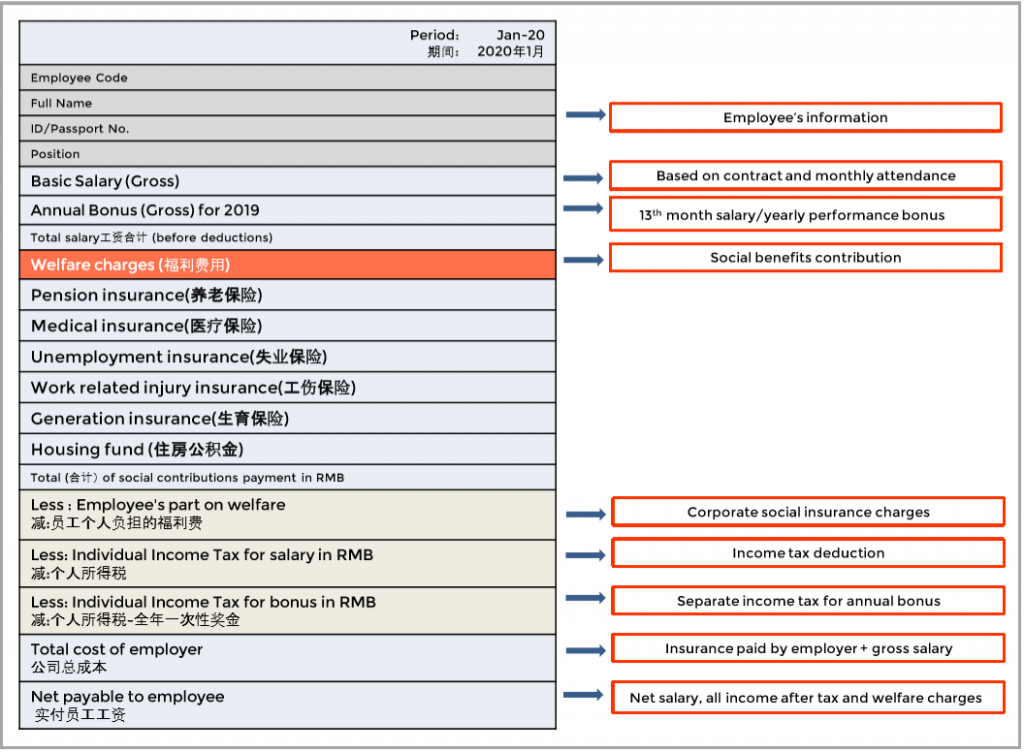

Below is a sample breakdown of a Chinese payroll which includes the payroll items.

The annual leaves and holidays are part of the basic monthly salary in the payroll. Chinese workers are entitled to 5 to 15 annual leave days per year. They also get a full wage payment for national or public holidays. Furthermore, an employee with less than 10 years of cumulative work experience gets a minimum of three months of sick leave.

For more details about paid annual leaves for employees in China, please refer to the Regulation on Paid Annual Leave of the Employees by the State Council.

Why hire a payroll service provider?

It saves time and resources.

With a payroll service provider, your HR managers can focus on other valued and business-related matters. You will also save the cost for an internal payroll process where you have to pay employees to do it. Often, small companies have many people handling various parts of the payroll process. Having an outsourced provider can help handle all the responsibilities involving payroll management as well as employee inquiries regarding their salaries.

It ensures compliance and avoids penalties.

Without a doubt, hiring a professional payroll service provider can help businesses avoid risks and penalties. An employee can face an overdue tax payment of 0.05 percent per day based on outstanding taxes. It is not only applied to Individual Income Tax (IIT) but also to Value-added Tax (VAT), Corporate Income Tax (CIT), and others.

It is stress-free.

You can expect your company to focus on other core functions once you know how to manage complicated processes involved in payroll. Your management can free itself from this aspect of financial stress as long as it can count on a trustworthy and efficient payroll service provider.

Hire us and get our Cloud solution for free.

It is not enough to simply have a payroll service provider to be confident about the compliance risk in China. Your provider should also have a standardized system in doing the payroll work. Nowadays, many companies whether big or small, are transforming their payroll system into a much more simplified process. Kwikdroid, for instance, enables smooth control of company management tools and applications. It is a Cloud- and AI-based solution that is integrated with accounting software and gives a detailed summary of your employee’s payroll in a more organized and timely manner. More importantly, you can get an overview of payroll-related information on Kwikdroid from any device, anywhere and anytime. It is also built with virtual support from our HR and accounting management to instantly address your concerns.

Our experts do the payroll for you, and you get to see their work on Kwikdroid from any device, whether you are at home, on-the-go, or at the office. To check our payroll service packages, please visit our Kwikdroid page.If you want to know more about doing business in China during the coronavirus outbreak, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!