On April 15, 2020, China’s Ministry of Finance released a notice to expand its loan and credit policies for startups and individual businesses. This comes as a support measure to the country’s business entrepreneurs as they resume work after the COVID-19 outbreak in China.

Have a look at our previous post about Support for FIEs in China during the COVID-19 Outbreak

As SMEs in China employ a majority of the national workforce, the Chinese government is keen to provide constant financial support in order to maintain employment stability. Keep reading to learn more.

Expanding the coverage of loan support

China’s Ministry of Finance (MoF) has identified new key groups eligible for the government’s loan support. It aims to help businesses resume their production and operation after the COVID-19 crisis.

The key groups under the expanded loan coverage are divided into five groups including individuals and business industries.

1. Industries that lost their sources of income

- Wholesale and retail

- Accommodation and catering

- Logistics and transportation

- Cultural tourism

- Industrial and commercial households

2. Individuals with car loans intended for rental operations

3. Full-time drivers with loans intended for ride-hailing and taxi industry (online car-hailing platform)

4. Qualified taxi drivers

5. Individual entrepreneurs who have paid off their loans on time but are having business difficulties

Loan application threshold

Previously, China limited its loan guarantee threshold for startups or individual businesses to 20 percent. The new loan policy, however, has decreased this threshold from 20 to 15 percent, giving more room for financial assistance among eligible borrowers. The same policy also stated that companies with more than 100 workers are only limited to an 8 percent threshold.

*The threshold percentage represents the number of new employees qualified for the entrepreneurial guarantee loan.

As the government lowers the threshold for the loan application, it increases its credit limit, giving more chances for startups and individual entrepreneurs to propel their businesses. Not only that, but they will also get the opportunity to increase their credit score rating given that they repay their loans on time.

Increasing the amount of allowable loan

Besides the expansion of loan coverage, China’s central government through Circular No. 21 also moved to increase the amount of loans available for virus-hit individuals. Thus, MoF augmented the maximum allowable loan amount from RMB150,000 to RMB200,000 this year.

Moreover, qualified individual borrowers having an entrepreneurial partnership can apply for an increased amount depending on the number of partnered entrepreneurs. The amount, however, should not exceed 10 percent of the allowable loan amount.

Extending the repayment period

SMEs and individual businesses including self-employed industrial and commercial households whose liquidity was affected by the epidemic can repay their loans until June 30, 2020. However, the finance department clarified that they will be charged with the usual interest rate during this extension period.

Meanwhile, individual borrowers who suffer from COVID-19 disease can extend their payments for not more than a year.

Lowered interest rates

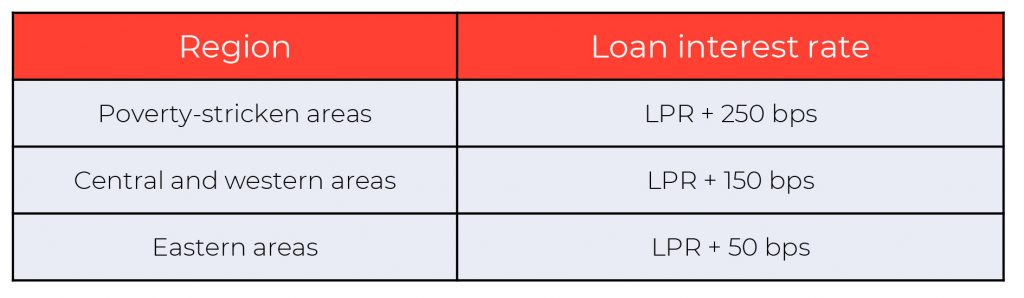

Recently, China has undertaken huge steps to cut the country’s lending rates in order to help the business economy recover from the repercussions of COVID-19. From previously 4.05 percent, the Central Bank cut the one-year loan prime rate (LPR) down to 3.85 percent, lowered by 20 basis points (bps).

Furthermore, the National Interbank Funding Center under China’s central bank announced a drop in the five-year LPR by 4.65 percent, 10 basis points lower than before. This is said to be the largest cuts since the rate was launched in August 2019. Such policy adjustment thus indicates a ‘serious monetary easing’ by the Chinese government.

The new loan rate policy for the newly launched business loan guarantee complements the national monetary easing effort of the government.

See the table below for the lowered interest rates for different regions.

Source: China’s Ministry of Finance

*Commercial banks typically charge interest rates to small businesses and individuals based on the LPR (loan prime rate). A country’s central bank determines the LPR. China introduced LPR in October 2013 through the People’s Bank of China (PBOC).

*The bps (basis points) refers to a unit of financial measure used to describe the percentage change in the value or rate of a financial instrument.

Shared payment of interest

The central government further eases the burden of individuals and small businesses with guaranteed loans by offering discounts on their payment. According to a reasonable sharing of interest, the government will shoulder the interest rate of 150bps, and the rest is carried by the individual or enterprise borrowers. This scheme will take effect on January 1, 2021.

Key takeaways

On April 3, 2020, the government announced an intensified national financing guarantee fund for small businesses and entrepreneurs. It allocated a total of RMB7.5 billion funding intended to mobilize SMEs amid the economic impact of COVID-19. It also stressed the role of government-backed financing guarantee and re-guarantee agencies. According to Circular No. 19, these guarantee institutions should halve guarantee fees for SMEs and provide further credit support. Besides, the government also decided to waive the anti-guarantee requirement for small businesses, merchants, farmers, and entrepreneurs who are stable and trustworthy.

Following various loan policies, China also ensured optimized services and simplified approval procedures related to loan guarantees. All local governments are also encouraged to relax lending conditions and increase borrowing limits. This also includes shared payment or additional discounts on interest rates.

China has announced the new debt financing policies and additional rate cuts to boost the economy and limit the long term effects of the COVID-19 pandemic.If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!