In 2017, the Chinese government passed the Overseas NGOs Law, enabling foreign non-profit bodies to set up an office in China. According to the law, there are two ways to register as an NGO, either by setting up a Representative Office or conducting temporary activities.

Have a look at our previous article on Representative Office in China: How to Set Up One?

To successfully operate as an NGO in China, interested individuals or parties need to seek advice on the proper procedures and related policies about NGOs or public welfare activities.

First step: determining the method of entering as foreign NGO into China

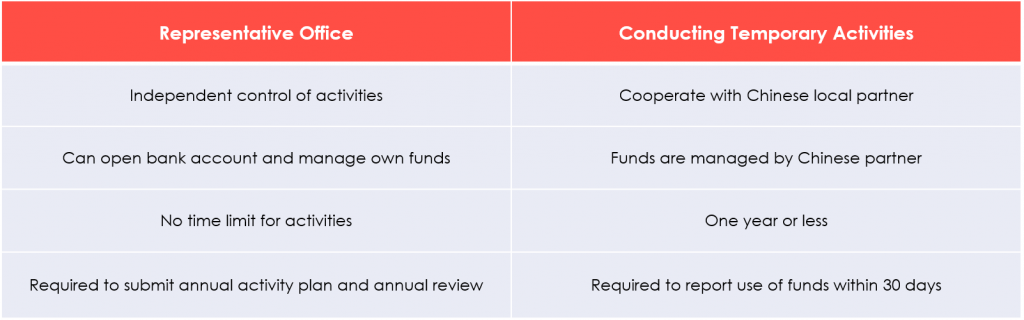

Most foreign NGOs prefer setting up RO in China because it would mean independent control of their activities. Moreover, there is no limit for the time they can operate with RO.

On the other hand, in conducting temporary activities, interested NGOs must cooperate with a Chinese partner. Following that, the Chinese counterpart’s bank account will manage the funds. Foreign NGOs that set up RO office can open a bank account with a local Chinese bank. Therefore, they will have sole responsibilities over their funds.

In terms of compliance, both ways also require submitting a report, showing their records of activities and use of funds. For RO, a foreign NGO must prepare to submit an annual activity plan and annual review. Meanwhile, foreign NGOs must report their use of funds within 30 days if they are conducting temporary activities.

Below is a summary of the differences between setting up RO and conducting temporary activities:

Second step: planning for foreign NGO application procedures

Depending on which entry method is chosen, the application procedures will require documentation and going through approval processes. But first, foreign NGOs need to know whether they are eligible to apply. According to Article 10 of the Foreign NGO law, the following are the relevant requirements to be eligible for entering China as NGO:

- With a legal establishment outside China;

- Can independently assume civil liability;

- Scope and objectives are beneficial to the development of public welfare;

- Two or more years of substantive activities held outside China; and

- Other requirements by authorities.

Note, however, that there are some types of NGOs that do not need to go through RO registration or filing a temporary activity. As such include foreign entities including schools, hospitals. natural science and engineering technology research institutions and academic organizations.

Nevertheless, there are some instances when, for example, a foreign school is subject to the Foreign NGO law. If a foreign school cooperates with a Chinese NGO or cultural institution other than a school exchange, it can be subject to the said law.

By legal definition, overseas NGOs refer to foundations, social groups, think tanks, and other non-profit or social organizations. They carry out activities in the field of economy, education, science, culture, health, sports, environmental protection, and poverty and disaster relief. Foreign NGOs may also enjoy tax exemption depending on their qualification.

Read more on Are NGOs in China Exempted from Taxes?

What is Professional Supervisory Unit?

Before application, the foreign NGO may first obtain approval from its Professional Supervisory Unit (PSU) that will determine whether the NGO meets the eligibility criteria. More importantly, the PSU will conclude based on the list of fields of activity (including project categories) the NGO is engaged in.

Third step: applying through RO or temporary activity

Establishing Representative Office

Documents required:

- A completed application form

- Documents proving eligibility and its relevant requirements

- ID, non-criminal record and the curriculum vitae of the person in charge of the proposed representative office;

- Proof of premises of the proposed representative office;

- Proof of source of supporting funds

- Approval letter from the foreign NGO in charge

- Other documents required by authorities

Procedures

Considering that the foreign NGO has obtained approval from the PSU, the following steps will proceed:

- Apply to the provincial Public Security Bureau within 30 days upon approval from the PSU.

- Submit the relevant documents required to PSB’s NGO overseas administration office.

- Once accepted, the PSB will issue a registration certificate containing the name, address, scope of operations, area of activities, chief representative, and the organizations in charge of operations.

- Finally, the foreign NGO can register for tax, company seal and bank account with the certificate of registration. The registration authorities will require a copy of tax registration, a sample of company seal and bank account details for filing purposes.

Conducting temporary activities

Documents required:

- Documents proving the foreign NGO’s legal establishment

- A written memorandum of agreement between the foreign NGO and the Chinese partner (indicating the time, content, and funds of the program)

- Detailed information of the temporary activity to be conducted (shown in the Form for Filing of a Foreign NGO Temporary Activity)

- Evidence of project budget funding sources as well as bank account information of Chinese partner (if the Chinese partner also contributes to funding, a proof of funding is also required)

- Approval documents from the PSU received by the Chinse partner

- Other documents required by authorities

Procedures

Since conducting temporary activities require a Chinese partner, it follows that the Chinese partner handles the registration procedures for the foreign NGO. Thus, the Chinese partner must take the following steps:

- Submit proposed temporary activities to the PSB’s NGO management administration along with the necessary documents 15 days before commencing the activities.

- The NGO management office will review the application. In case of disapproval, the authorities will require immediate cease of operations or activities.

- The Chinese partner must submit a detailed report regarding the use of funds within 30 days after project completion.

Note that in case of emergency situations where the foreign NGO needs to conduct, for instance, disaster relief and rescue operations, the 15-day rule does not apply.

All documentation required for setting up NGO RO or filing temporary activity must be notarized and authenticated. The notarization authority may also differ for Hong Kong, Taiwan and Macau foreign NGOs.

- Hong Kong – notary public in mainland China

- Taiwan – notary public in Taiwan

- Macau – notary public in mainland China or notary department of Macau government

Key takeaways

Foreign NGOs may end up being rejected especially if they decide to apply via temporary activity. There can be difficulty of finding a local partner to cooperate with or in case of RO, securing approval from the PSU. Thus, China provides the right to appeal to the Ministry of Public Security.

Recently, the Chinese government launched a crackdown on phony charities. That is, authorities are chasing after illegal NGOs. Hence, it is important for any interested foreign NGO to register before attempting to enter China and conduct social activities.

How can we help?

S.J. Grand provides a range of services to foreign groups or individuals who want to do business or set up a non-government organization office in China. We take care of the relevant procedures and advise you on the best ways to enter China whether as a business entity or as an NGO. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!