Is ESG relevant for the SMEs in China? The short answer is yes. Below we outline three main reasons.

EU regulating the supply chain

Chinese regulations concerning ESG reporting are mandatory only for the listed companies, however regulations for the large companies located in the EU also cover the supply chain.

EU regulations governing large companies mandate ESG reporting, which also should cover the supply chain. Therefore, China located companies engaged with EU-based counterparts will soon (and some are already) be required to provide additional ESG data, specifically when it comes to carbon emission.

These regulations also encompass financial institutions. In order to have a full view of the customer operations, banks and insurance companies will soon start requiring their SME clients to provide more comprehensive ESG information related to their China operations.

China goes green

In September 2020, Chinese President Xi Jinping announced that the country would peak carbon emissions before 2030 and achieve carbon neutrality before 2060. The Chinese Government views green finance as pivotal in achieving 2030 and 2060 carbon emission targets: as announced in 2021, the main focus for the Central Bank is the development of green financial mechanisms. What does this imply? In short, Chinese banks and investors will start requiring their clients and targets to provide information focused on environmental factors, with a particular emphasis on carbon emission.

Covid-19 and Gen Z lead the change

According to McKinsey & Company, Chinese consumers are willing to pay a premium of 10-15% for sustainably crafted products. The new player on the market – Gen Z consumer has different buying habits and is leading the behavior change: now brand needs to align with personal values, especially when it comes to sustainability and eco-friendly practices. Change in China happens fast: in the past few years, especially during Covid-19 pandemic and lockdowns, overall Chinese consumer preference started shifting towards sustainable products. Which means only one thing: for companies looking to participate in the surging trend of sustainability-conscious consumers in China prioritizing proper ESG management and reporting is becoming essential.

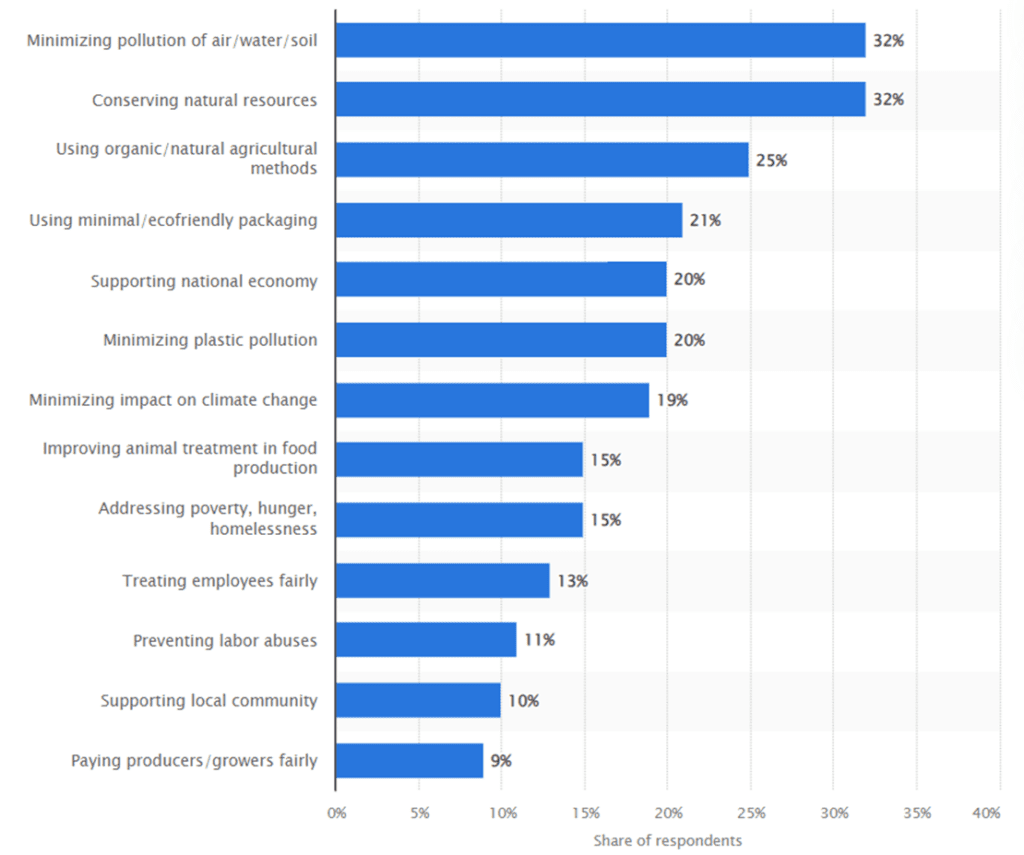

Important Benefits Considered by Adults in Purchasing Sustainable Products in China as of April 2021:

@ Statista 2023

Corporate sustainability is not a one-size-fits-all approach; it requires a tailored strategy that fits your company’s unique context and industry. S.J. Grand Financial and Tax Advisory assists foreign firms in navigating the complexities of operations and investments in Greater China since 2003.

Reach out to our experts for any related queries.

S.J. Grand is a full-service accounting firm focused on serving foreign-invested enterprises in Greater China. We help our clients improve performance, value creation and long-term growth.

Other Articles:

- Due Diligence In China Direct Acquisitions

- Corporate Health Check – Is Your China Business in Good Health?

- Expat Taxes in China: Individual Income Tax (IIT), Social Security and the 6-Year Rule

- Dr. Stephane Grand Shares Insights with the Financial Times on the Amended China Company Law

- China Joint Venture: A Win-Win?