On February 18, 2020, China’s Premier Li Keqiang presided an executive meeting of the State Council to implement policy initiatives for businesses. In the meeting, Li stressed the importance of policies that can support enterprises in surviving the coronavirus crisis. As small and medium-sized enterprises (SMEs) account for a huge part of the Chinese GDP, they play a key role in the country’s employment and its stability. Thus, Chinese officials saw the need to tackle the risk of the COVID-19 epidemic to SMEs.

Read our previous article on COVID-19 Update: China Eases Business Difficulties

As part of the efforts to assist companies during the epidemic, the Chinese government announced a reduction of social contributions by various enterprises. This includes social insurance costs and housing funds contributions. Keep reading!

Reduction of social insurance costs

The State Council policy prioritizes the reduction or exemption of social insurance fees that enterprises pay for their employees. This includes the three kinds of social insurances – pension, unemployment, and work-related injuries. It will supposedly minimize the impact of the novel coronavirus on small and medium-sized companies.

The pension contributions and insurance fees cut this year is worth RMB 500 billion (USD 71.27 billion). This amount of money “freed” by the government will help companies to continue their projects and not delay them. According to the report, the reduced fees have exceeded the last year’s cost which was RMB 400 billion worth.

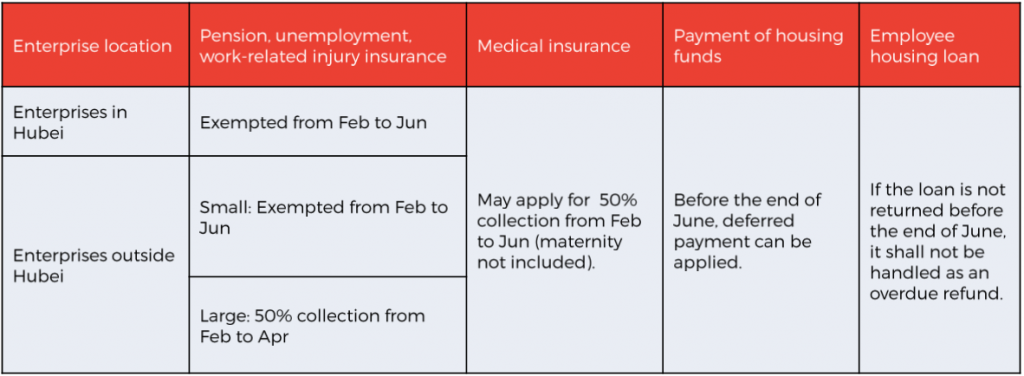

The government will exempt the corporate social insurance premiums for SMEs from February 2020 to June 2020. On the other hand, larger enterprises will pay half of the contribution to social insurance from February to April 2020. Both small and large enterprises located in Hubei province, however, will not pay for social insurance from February to June 2020. Meanwhile, from February to December 2020, the social insurance medical rate for the employer’s part (including maternity insurance) will reduce by 0.5%.

Besides the preferential policy for social security, the government will also defer payments for housing provident funds. Companies can delay housing funds payments to keep working capital as high as possible. Through this, employees can minimize the risk of overdue payments into their housing funds. But at the same time, they will still receive their housing fund as usual with no changes in related loans.

The table below shows a summary of the reduction benefits for social insurance for only the employer’s part and deferred payments for housing funds during the coronavirus outbreak.

Small and medium enterprise criteria

The new social insurance policy will need further clarification in terms of which businesses fall into the SME category. Nevertheless, enterprises can refer to the Notice on Printing and Distributing the Provisions for Standardizing of SMEs (MIIT [2011] No. 300). The said notice shows the details for specific industries. It takes into consideration the number of employees, total revenue or total assets of the enterprises.

Implemented regulations for Shanghai and Beijing

Social insurance premiums

- SMEs: Exempt from February to June

- Other enterprises: 50% collection from February to April. In Beijing, the pension rate is reduced to 8% and the unemployment insurance rate is to 0.4%.

- Enterprises with serious difficulties in production and operation may apply for postponement of payment. The latest payment date is December 31, 2020.

Housing provident funds

- Defer payments from February to June.

Medical insurance

- Shanghai: From February to June, the basic medical insurance rate carried out by the enterprise is reduced from 10.5% to 5.25%, the rate for regular employees remains the same at 2%.

- Beijing: Basic medical insurance premiums are collected by half.

Employment adjustments

The government will also set up preconditions for production recovery, cancel unnecessary deposits and ensure employment of key groups. It also plans to extend the timeline for graduate recruitment for jobs. Moreover, the government will support enterprises in adding flexible jobs to meet online consumer demand.

The State Council also ascertains full and prompt payment of unemployment insurance to laid-off workers. According to the announcement, the unemployment insurance fund should be distributed to unemployed people in a timely manner to cover their living expenses before they secure new jobs.

Key takeaways

According to Vice Finance Minister Yu Weiping, the impact of the cuts on payments on government revenue would be manageable. “In the short-term, those measures will lead to a reduction in revenue of government funds, but in the long run, it will reduce the burden on companies,” Yu said. Chinese officials expect that with the improvement of corporate performance, China’s tax base can be expanded and thus, the fiscal revenue will gradually improve.

As social insurance is managed on a regional basis, the specific implementing measures may differ from one local government to another. You can contact us for more information regarding updates from your locality.If you want to know more about doing business in China during the coronavirus outbreak, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!