China has introduced yet another law concerning stamp duty that took effect on July 1, 2022. The law aims to simplify tax items and tax cuts mainly for written documents such as accounting books, contracts, certificates, and other relevant materials.

Have a look at our previous article on Deed Tax Law – What it Means for Enterprises in China?

Prior to the approval of the stamp duty law, China normally applied the 1988 interim regulations for the payment of stamp duties. Thus, it has been repealed with the implementation of the Stamp Tax Law.

What is stamp duty?

Stamp duty refers to the tax paid by individuals, enterprises, investors, and other entities on certain written documents, licenses, and certifications from the granting authorities. It may not be a major tax liability especially for businesses, however, non-payment of such may result in tax penalties that can be a total waste of resources.

According to the current provisional rules, the following documents are subject to stamp duty:

- Relevant to purchase and sale, processing contracting, construction project contracting, property leasing, cargo transportation, warehousing and storage, loan, property insurance, technology contract or contractual certificates;

- Transfer of property;

- Accounting books for businesses;

- Relevant to rights and licenses; and

- Other taxable documents as required by the Ministry of Finance.

On the other hand, documents that are exempt from stamp taxes include:

- Duplicate copies of stamp tax payments;

- Relevant to the donation of property to the government, social welfare unit, or school; and

- Other non-taxable documents approved by the MoF.

New changes – stamp duty simplification

IPR transactions

Despite the promulgation of the new law, there are not many changes from the interim regulation of 1988. However, the law claims the reduction of stamp tax on intellectual property transactions from 0.05 percent to 0.03 percent. Documents for the transfer of trademark, copyright, patent right, and know-how will obtain the said reduced tax rate.

As for patent grants, the stamp tax amount of RMB 5 will be eliminated. Patent grants refer to trademark and patent registration certificates or licenses.

Contracts and capital records

The reduction of the stamp tax rate from 0.5 percent to 0.3 percent also includes processing, transportation, and construction contracts (except for construction engineering survey and design).

On another note, the stamp duty rate for the records of paid-up capital and capital reserves is also reduced from 0.5 percent to 0.25 percent.

Other non-taxable documents under the new law

- A copy of the taxable certificate

- Foreign embassies, consulates, and representative offices of international organizations in China in accordance with the law

- Purchase and sale contracts relevant to agricultural insurance or purchase of production materials for agriculture as well as selling agricultural products

- Documents issued by the Chinese People’s Liberation Army and the Chinese People’s Armed Police Force

- Loan contracts (including no interest or discounted loans) established by the international financial organizations for the provision of preferential loans to China

- Purchase and sale contract relevant to the purchase of drugs or sanitary materials by non-profit medical and health institution

- Electronic orders entered into by individuals and e-commerce operators (orders between e-commerce businesses and business buyers such as enterprises are still subject to stamp tax)

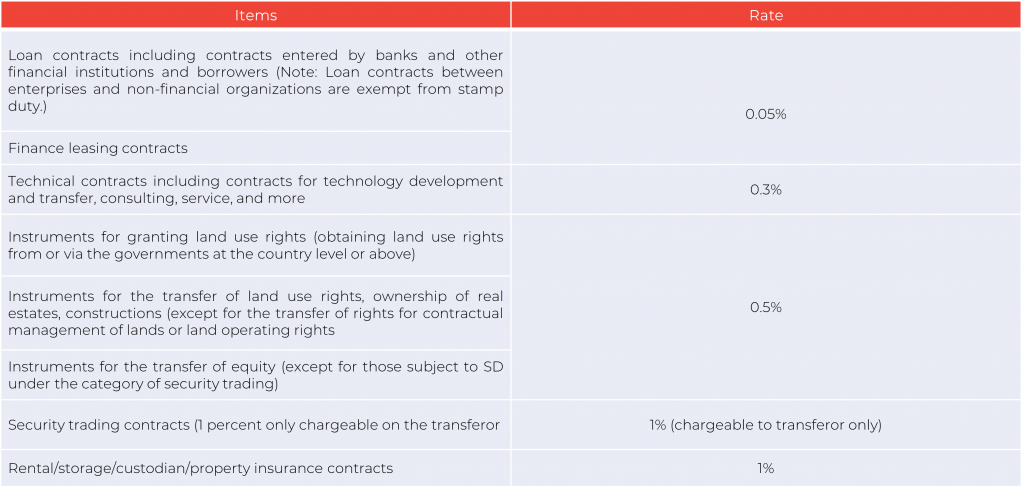

Unchanged stamp duty rates

Stamp duty also applies to documents involving the transfer of land use rights to Wholly Owned Foreign Enterprises. Both the transferor and the transferee will have to pay a 0.05 percent stamp duty rate. This has remained unchanged under the new Stamp Duty Law.

Furthermore, securities share trading transactions will remain chargeable for stamp duty as China does not have capital gains tax on this.

Other unchanged items include the following:

Key takeaways

China continues to standardize and simplify its rules and regulations related to the conduct of both local and foreign businesses. Thus, recent laws such as the Stamp Duty Law, Deed Tax Law, and more have come into being.

Under the new Stamp Duty Law, tax authorities do not include specified VAT amount in the calculation basis for stamp charges. This leads to a possibility of charging the unspecified VAT document to the entire amount of stamp duty. Thus, taxpayers need to distinguish the VAT amount from the contract price indicated in the taxable contracts or documents. Seeking professional advice is necessary to ensure accurate application of duty charges.

Contact Us

S.J. Grand provides advisory and support on the business set up as well as tax and accountancy services for foreign-invested companies in China. We assist foreign companies with tax optimization strategies to take advantage of China’s various preferential policies. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!