You finally gave up on doing business in China or you just want to sell a profitable company for a good reason. But as a business owner, you are confronted with the tax responsibilities attached to it. Especially in China, tax liabilities on transferring shares may depend on your residency status. Recently, the new IIT law has specifically categorized tax residents or non-residents in China. This residence status then generates the tax implications of selling your company.

Have a look at our previous article on the Implementing Regulations of the new IIT Law in China

In this article, you will get an overview of what happens when you sell your company based on your tax residency. It aims to provide you with insights on how to avoid tax risks whether as an individual or company shareholder.

Tax residency status

Any individual with resident status in China is subject to the Chinese tax system. According to the new IIT law, an individual will be treated as a tax resident if he or she stays in China for more than 183 days within one calendar year. On the other hand, if an individual stays in China for less than 183 days, he or she is considered a non-resident taxpayer. This means that he or she will only be taxed based on China-sourced income.

However, a person can be resident yet non-domiciled. This means that the person does not permanently live in China but rather habitually. A foreigner can be classified as non-domiciled. A non-domiciled, tax resident individual may be taxed on his or her worldwide income unless he or she falls under the new six-year rule tax exemption for foreigners in China.

Also, check out our recent article about Foreigners in China: How to Qualify for a Tax Exemption

For the purpose of this article, we will be dealing with whether you are a resident or a non-resident in China while selling your company.

Definition of terms

Before we provide you with the cases related to selling your company and its tax implications, we will first introduce some useful terms related to selling your company.

Capital gain

A profit made from the sale of a capital asset (investment or real estate). The gain is not realized until the asset is sold. A capital gain may be short-term (one year or less) or long-term and must be claimed on income taxes.

Example 1 (long-term): Mr. X buys a house in Shanghai at RMB300,000. As time passes, the real estate market of Shanghai surges. He decides to sell it in 2020 at RMB1,500,000. His capital gain is RMB1,200,000.

Example 2 (short-term): Mrs. Y buys a car in January 2019 at RMB60,000. She decides to sell it for RMB80,000 in August because she does not need it anymore. Her capital gain is RMB20,000.

Capital Gain Tax (CGT): A tax on the gain you make (not on the amount of money you receive) from the sale of a capital asset.

- Long-term capital gains tax depends on your tax bracket. The rate is 0 percent, 15 percent, or 20 percent.

- Short-term capital gains are taxed as ordinary income.

The CGT is calculated using the formula: Selling Price – Capital cost x 10 percent (company shareholder) or 20 percent (individual shareholder).

Dividends

A sum of money paid regularly by a company to its shareholders out of its profits (or reserves). It is important to distribute the dividends to the foreign parent company or shareholders before selling your company in China. Sending dividends requires an annual audit by an external accounting firm.

Leanr more about Dividend Distribution to Foreign Shareholders

Holding Company

A company that does not conduct any operations, ventures, or other active tasks for itself. Instead, it exists to own assets. The holding exists mostly to create a link between different companies (which is a group in the end). Further, the physical owners of the company own the holding itself.

Company shareholder

A limited company that owns shares in another limited company.

Individual shareholder

A person (that is not an institutional investor or part of an employee shareholders’ agreement) owning shares in a limited company.

Tax implications of shares transfer

A shareholder can come across many unique cases during the sale of a company. However, we will only present four basic assumptions that are based on the rule of tax residency in China. For specific assumptions related to the sale of your company not covered in this article, consult with our team to get a more detailed advice.

General Assumptions:

- The individual shareholder sells 100 percent of shares for direct transfer.

- The business value of the holding company is 75 percent and the shares of the company outside China are 25 percent. If the individual or company shareholder declares over 25 percent shares, the sale will be subjected to 20 percent CGT for individual shareholders and 10 percent CGT for company shareholders. Otherwise, if both shareholders own less than 25 percent of shares, the sale will not be subjected to taxes. However, non-China source-based income is taxable depending on the share’s ratio.

- If the individual or company is a non-resident in China but has residency status in a country with a tax treaty with China, tax exemptions may also apply.

The following four scenarios apply when the shareholder owns over 25 percent shares of the company.

Types of transfer of shares

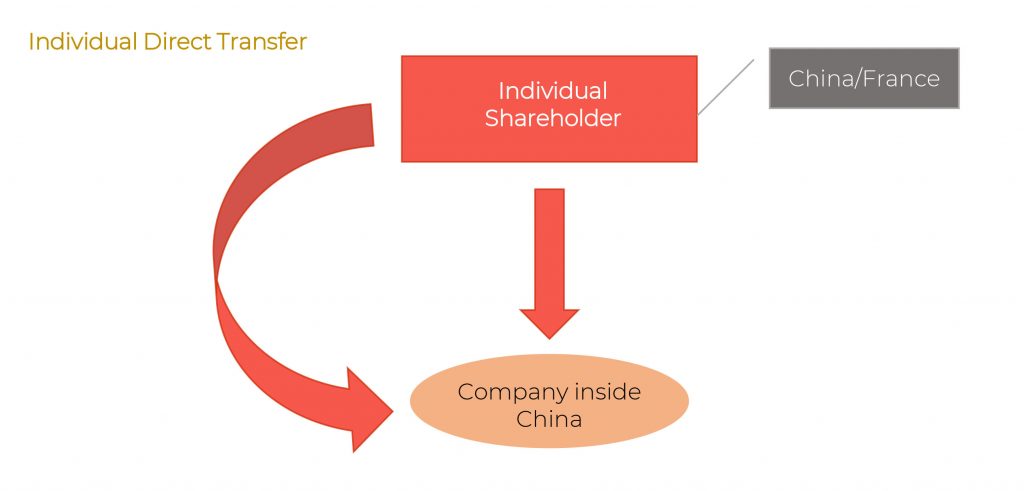

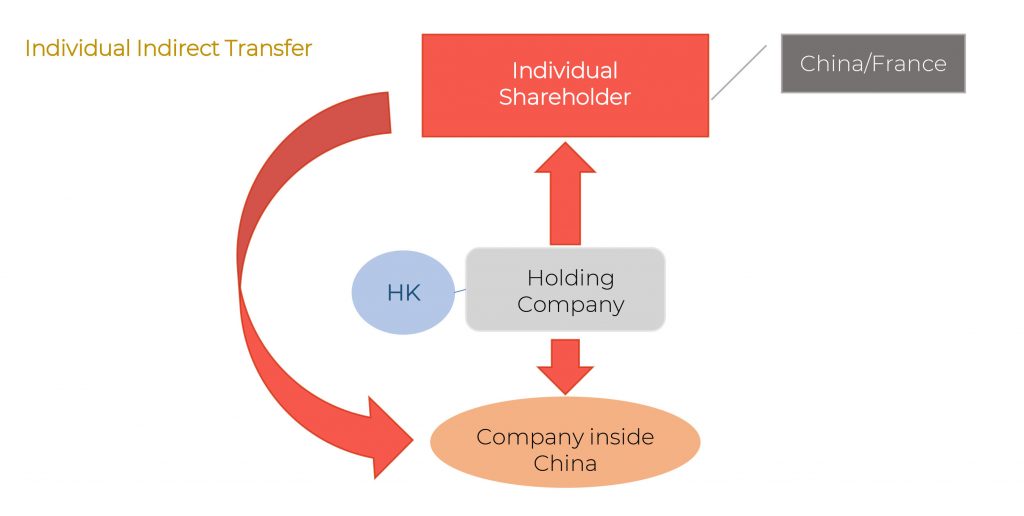

Individual direct and indirect transfer

Resident: The individual shareholder pays 20 percent capital gain tax or CGT.

Non-resident: The individual shareholder also pays 20 percent CGT unless exempted from China taxes on the capital gain. A tax exemption applies under a tax treaty that meets the following conditions:

- The shareholder owns less than 25 percent shares of the company within 12 months before the transfer of the shares.

- The company’s property value in China is less than 50 percent.

For resident: The individual shareholder is an indirect shareholder of an intermediate holding company (outside China) which also owns shares of a company inside China. The individual shareholder which owns the holding company pays 20 percent CGT (as taxable overseas income) when he or she takes out and uses the funds from the sale of the company or receives dividends from the holding company outside China. This means that he or she will face double taxation – 10 percent CGT for the holding company outside China and 20 percent capital gains taxable income in China.

For non-resident: The individual shareholder is exempted from taxable income unless 20 percent of CGT is considered as more than 75 percent of the asset value of the holding company or over 90 percent income from China.

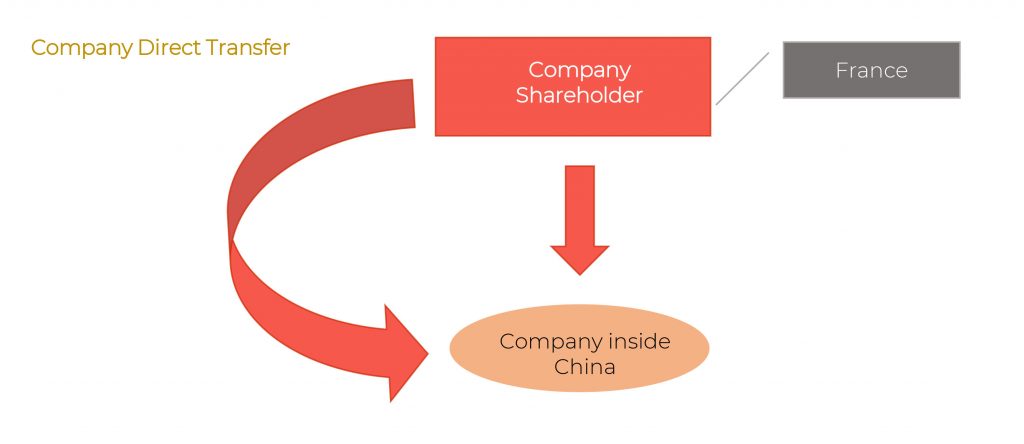

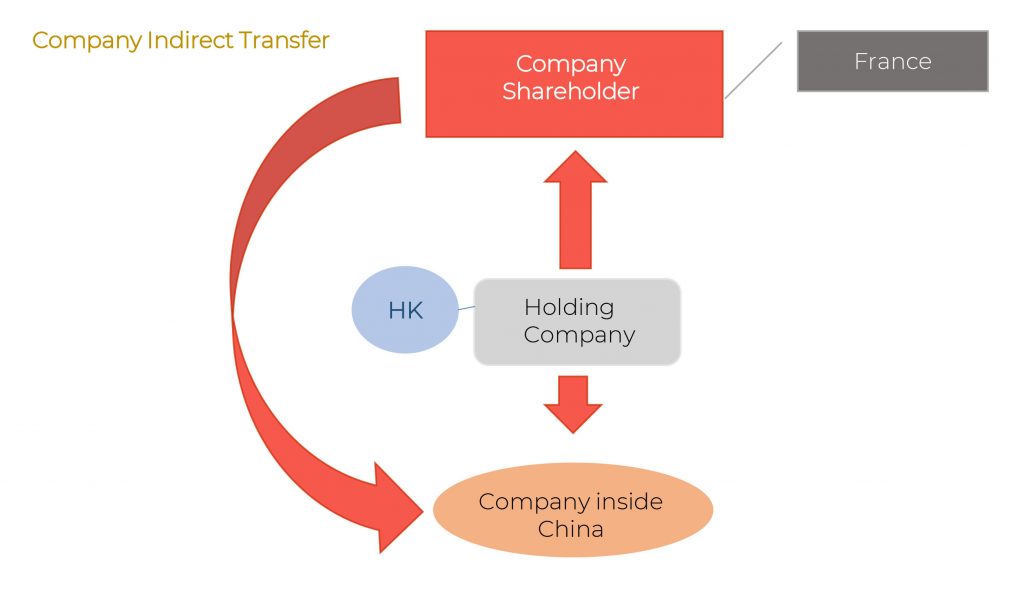

Company direct and indirect transfer

This type of transfer only applies to non-resident status.

The individual and company direct shareholders share the same conditions for this type of transfer.

For indirect transfer, the company shareholder is exempted from taxable income based on a reasonable commercial purpose. Otherwise, the company shareholder pays 10 percent CGT considered as more than 75 percent of the asset value of the holding company or over 90 percent income from China.

A case for operational entity type of share transfer

In an operational entity type of investment, an individual (not an agent) enterprise, or organization holds ownership of a business venture. It acts as a stakeholder in regular businesses and takes care of business operations. For example, in a distribution system, a product is usually sold to the customer through operational entities.

The share transfer system for an operational entity can have a complex tax implication. For example, the buyer or share transferee can opt to buy either the company inside China or the company outside China which owns it or both. In this scenario, it is best to consult a tax advisor to see what further tax implications there are.

In some particular situations, the seller of the company can benefit from capital gains tax protection under specific conditions.

(This article was published in April 2020, and was updated in November 2020.)

Contact us

S.J. Grand’s corporate finance services extend to Mergers & Acquisitions advisory, especially during the COVID-19 times. We also offer due diligence and other financial advisory services to help you succeed in your business ventures. Contact us to make an appointment.

Also, check out our latest Cloud-based company solution and go to our Kwikdroid page to check the prices and packages we offer, no matter the size or type of company.

If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.

See how much salary you receive after tax and check your company value without leaving WeChat!

Also, our Mini Program can estimate the salary in your industry, for your experience level and position. A huge help for salary negotiations!