China’s Individual Income Tax (IIT) and social security systems are integral components of the country’s economic framework, influencing both residents and expatriates working in China. Below is an introduction to China IIT, social security contributions and the 6-year rule for expats.

Tax Residency

According to the IIT Law, the individual meeting one of the following criteria will qualify as a tax resident in China:

- Is domiciled in China: habitually residing in China due to household registration (户口 hukou), family or economic ties, etc. (Article 2, 2018 Implementation Regulations of IIT Law). This usually applies to the Chinese nationals.

- Is not domiciled in China but resides in China for 183 cumulative days or more during a tax year. Usually applies to expatriates in China.

Non-residents are those staying less than 183 days a year and generally taxed in China on the China-sourced income only.

Types Of Taxable Income

China IIT law divides personal income into 9 categories:

- Income derived from employment or contracted labor services

- Author’s income paid by an organization within China

- Royalties

- Business income

- Interest, dividends, and profit distribution

- Rental income

- Income derived from property transfer

- Incidental income paid by an organization or resident individual within China

Each income category has its own tax rate(s), allowable deductions, etc.

For residents, income for employment and contracted labor services, author’s remuneration, and royalties are combined as ‘comprehensive income’. Other income is taxed separately on a monthly or transaction basis with a flat rate of 20% unless there are special reductions.

China Compensation Structure

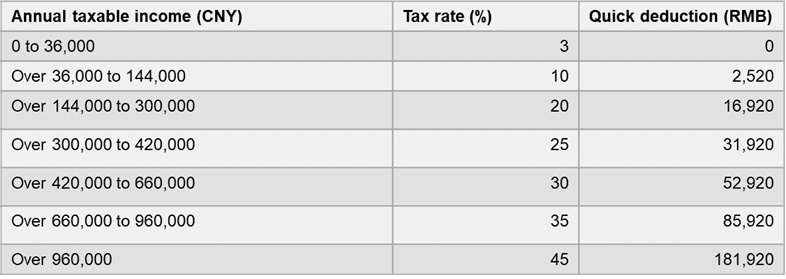

Calculation of IIT on annual comprehensive income is based on progressive tax rates using the following formula:

(Annual taxable income x Tax rate) – Quick deduction

Where the annual taxable income is:

Annual taxable income = annual comprehensive income – statutory deduction of RMB 60,000 – special deductions – special additional deductions – other qualified deductions – qualified donation.

Filing and Payment

https://sjgrand.cn/annual-compliance-for-china-companies/Employers deduct IIT from employees’ wages monthly. Annual filing is required for the resident taxpayers with multiple income sources or additional deductions, with a deadline of June 30 of the following year.

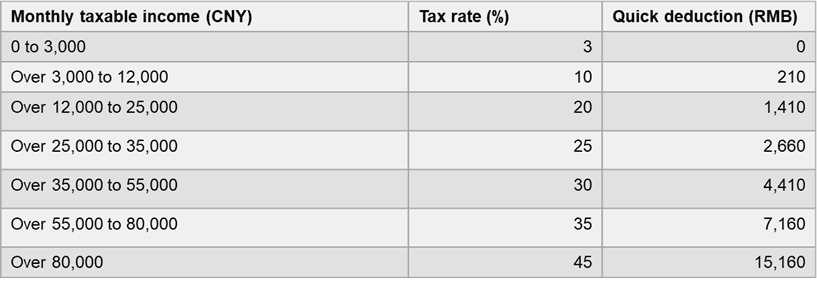

Tax rates

China has progressive rates for wages and salaries: monthly taxable income is taxed at rates ranging from 3% to 45%; and flat rates for other income types: royalties and dividends often face flat rates around 20%.

- Residents

- Non-residents

Social Security Contributions

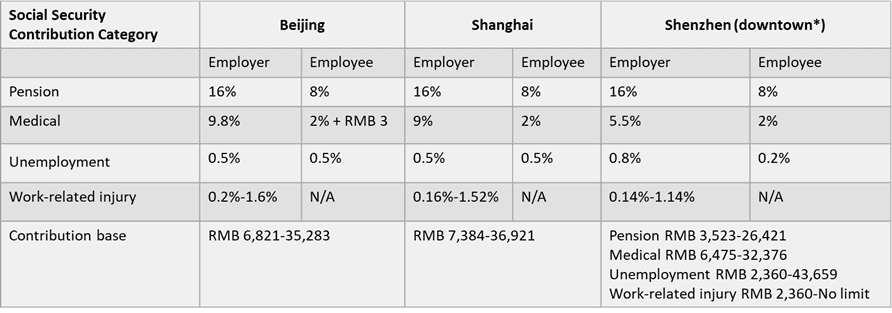

China’s social security system is another critical component of the social safety net, providing benefits such as pensions, medical care, unemployment insurance, work-related injury insurance, and maternity benefits.

Since 2011, expatriates working in China are generally required to contribute to pension, medical (including maternity), unemployment, and occupational injury welfare.

Social security contributions are divided in employer and employee parts and are regulated by local governments; therefore, rates and caps will vary depending on the location. For example, contribution rates and caps applicable to foreign employees in Shanghai, Beijing and downtown Shenzhen are as follows:

*In Shenzhen rates differ depending on location.

IIT Return Filing

ITT return is filled from March 1 to June 31. The individuals who fall into the scenarios below are required to perform IIT return filing:

- Multiple Sources of Income: individuals with income from more than one source, such as wages, dividends, and rental income.

- High-Income Earners: individuals whose annual income exceeds RMB 120,000.

- Claiming Additional Deductions: taxpayers wishing to claim special deductions that were not accounted for in the monthly withholding process.

In recent years China has increased the standard deduction, introduced more special deductions, and adjusted tax brackets to alleviate the burden on lower and middle-income earners.

Standard Deduction: RMB 5,000/month for resident taxpayers.

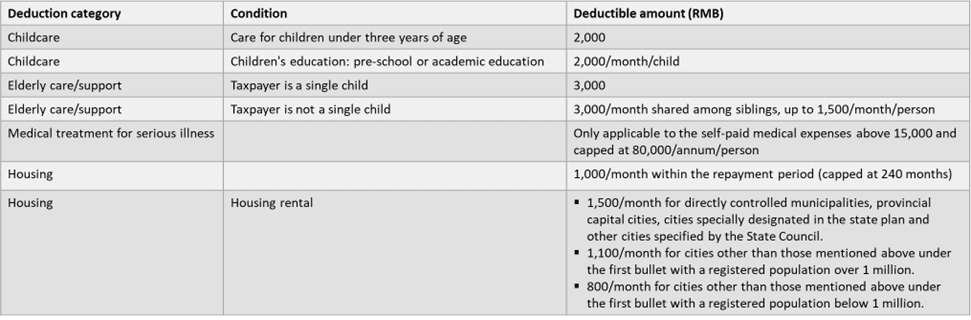

Special Deductions: Cover expenses for children’s education, continuing education, serious illness medical expenses, housing loan interest or rent, and elder care.

Additional Deductions: Contributions to social security and housing funds can also be deducted.

Specific additional deductions:

Tax-Exempt Benefits for Expatriates

China has extended preferential IIT policy for expatriates until the end of 2027. This policy includes the following tax-exempt items:

- Housing allowance

- Meal allowance

- Laundry allowance

- Relocation expenses when starting/ending an assignment in China

- Business travel allowance in/outside China

- Allowance for up to two round trips to the home country

- Allowance for language training

- Allowance for child’s education

A foreign employee in China can enjoy these benefits as long as he can provide the supporting documents (fapiaos, contracts, receipts, boarding passes, etc.) and the amount of the allowance is reasonable.

China Social Insurance Social Security Exemption Agreements

Totalization agreements allow foreign employees from the following countries to be exempt from participation in certain types of social security contributions if the relevant conditions are met:

Canada

Denmark

France (pending)

Finland

Germany

Japan

Luxembourg

Netherlands

Serbia

Spain

South Korea

Switzerland

6 Year Rule

The six-year rule is a crucial consideration for expatriates working in China. This rule impacts the tax residency status and the extent of tax obligations.

According to the rule, starting 2019 onward if an expatriate resides in China for more than six consecutive years, they become subject to tax on their worldwide income. To reset the six-year count, expatriates must spend at least 30 consecutive days outside China within a calendar year.

The first six-year rule cycle concludes in 2024.

China Double Tax Treaties

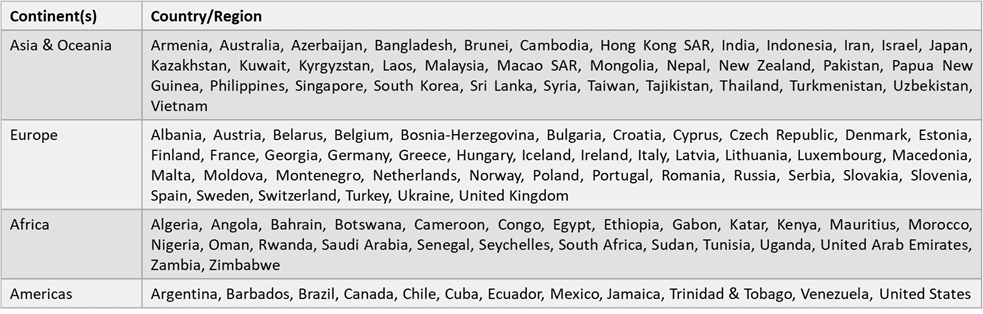

As of June 30, 2024, China has entered into tax treaties or agreements with 114 countries and regions.

Understanding of the implications of China IIT policies is necessary for the long-term career and residency decisions. Reach out to our team at contact@sjgrand.cn for a consultation.

Latest Articles: