If you are getting ready to leave China for good, it is helpful to know some of the things that you can take advantage of. For instance, if you have worked in China for a while, you might want to claim a refund of your social security payments. Especially, if you are leaving or have left China, there is a possibility to reclaim your payments as mandated by Chinese law.

Read more about Things to Do Before Leaving China for Good

Think of it as your takeaway after living in China for a certain period. Keep reading and find out more details about social insurance refunds.

What type of social insurance can foreigners refund?

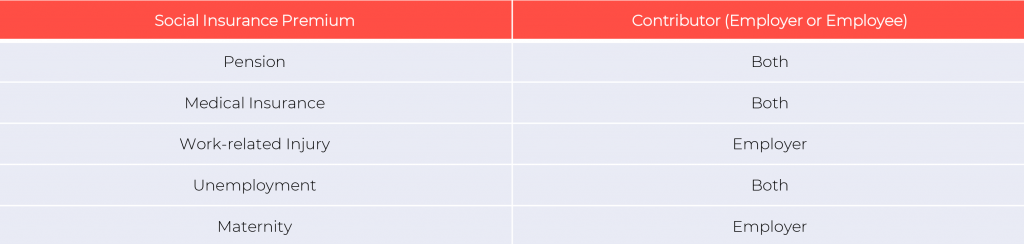

Under the Chinese social insurance (SI) scheme, there are five types of social insurance premiums that both employers and employees should pay.

Social insurance premium payments

Among the contribution items mentioned, however, foreigners can only get a refund of their medical insurances and pension. Typically, foreigners can opt out of these social securities, but some local cities have made the payments mandatory. Those living in cities with mandatory SI payments can still take advantage of exemptions based on their country of origin. In short, bilateral agreements may allow some countries to opt out of the scheme.

See further benefits for foreigners here: Double Taxation Relief for Foreigners in China

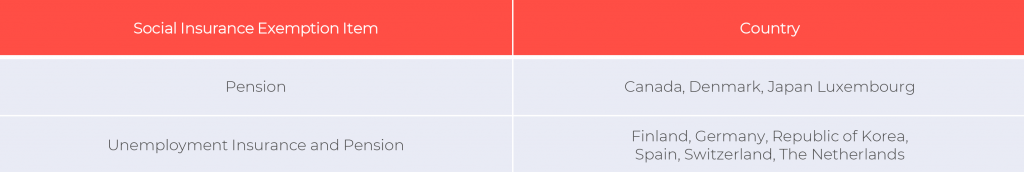

Countries exempted from mandatory SI under the Bilateral Social Security Mutual Exemption Agreement with China

Source: Ministry of Human Resources and Social Security

To note, Article 4 of the Interim Measures for Social Insurance System Coverage of Foreigners mandates that employers should register for the foreign employees’ social insurance within 30 days from the date of processing their work permits.

Why should you consider making contributions?

China’s rule on social insurance indicates that there are no unemployment benefits granted to foreigners unless they have permanent residency. However, foreigners can enjoy a monthly pension, given that they have contributed to it while working in China for 15 years or more. They can also receive this retirement fee even if they live abroad. But on one condition that they must present proof of their physical presence in the country they live in. The formula below shows a sample calculation of the individual pension amount.

Monthly pension (RMB 1,200) x months in a year (12) x years of assignment in China (2) = RMB 28,800

Aside from pension, foreigners are also entitled to a refund of the paid and unused part of medical insurance. Both items shall be refunded in a lump sum before a foreigner leaves the country.

Check out our article on IIT and Social Insurance for foreigners employed in China

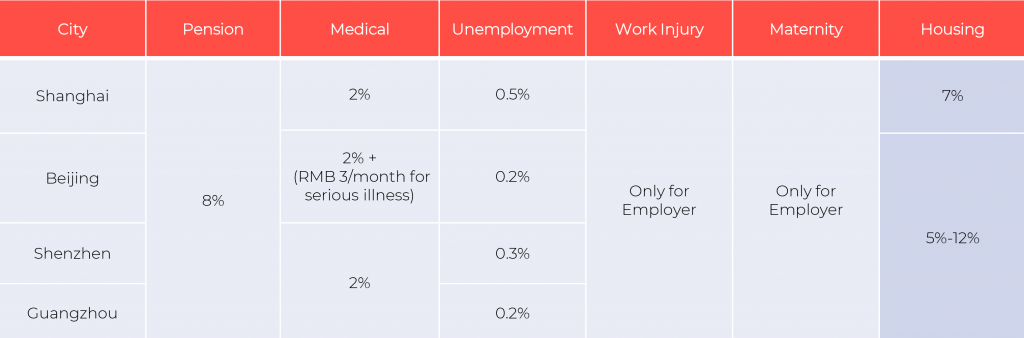

Social contribution rates in major cities for employee

*Foreign employees cannot refund social insurance on housing.

Are social insurance premiums taxable?

Both tax residents and non-residents in China are subject to taxable income. However, based on the new IIT law, a non-resident is only taxed on his or her income earned in China whereas he or she has lived in China for 183 days or less within a tax year. On the other hand, a resident individual is taxed on both his or her China-sourced and overseas income.

On the China-sourced taxable income, an employee’s social insurance contribution along with special itemized deductions items are deducted before the calculation of the IIT. Furthermore, the total insurance amount is deducted before the total net payment given to the employee.

Find out more about foreign workers allowances here: Expatriates in China – Tax Updates on Allowances

Sample Calculation (Shanghai-based):

A gross salary of RMB 25,000 with a total net pay of RMB 20,350.55.

- Total Taxable Income = [Gross Salary – Monthly Fixed Deduction] – [Total Deductions (Social Insurance+ Special Deductions)]

RMB 11,289.22 = [RMB 25,000 – RMB 5,000] – [RMB 8,710.78 (RMB 4,310.78 + RMB 4,400)]

- Deductible Tax Amount = Total Taxable Income x Tax Rate

RMB 338.68 = RMB 11,289.22 x 0.03 (3%)

- Total Net Pay = Gross Salary – [(Deductible Amount + Social Insurance)]

RMB 20,350.55 = RMB 25,000 – [(RMB 338.68 + RMB 4,310.78)]

*Special deductions include children’s education (RMB 1,000), continuing education (RMB 400), housing loan (RMB 1,000), and eldercare cost (RMB 2,000).

Find more information here about How to Qualify for a Tax Exemption

Getting a refund of your paid social insurance

The social insurance account of a foreigner can be continued and calculated cumulatively after returning to China for another employment. If a foreigner has retired upon the age limit or decided to leave China for good, he or she can terminate the individual SI account and apply for a refund of the paid SI items.

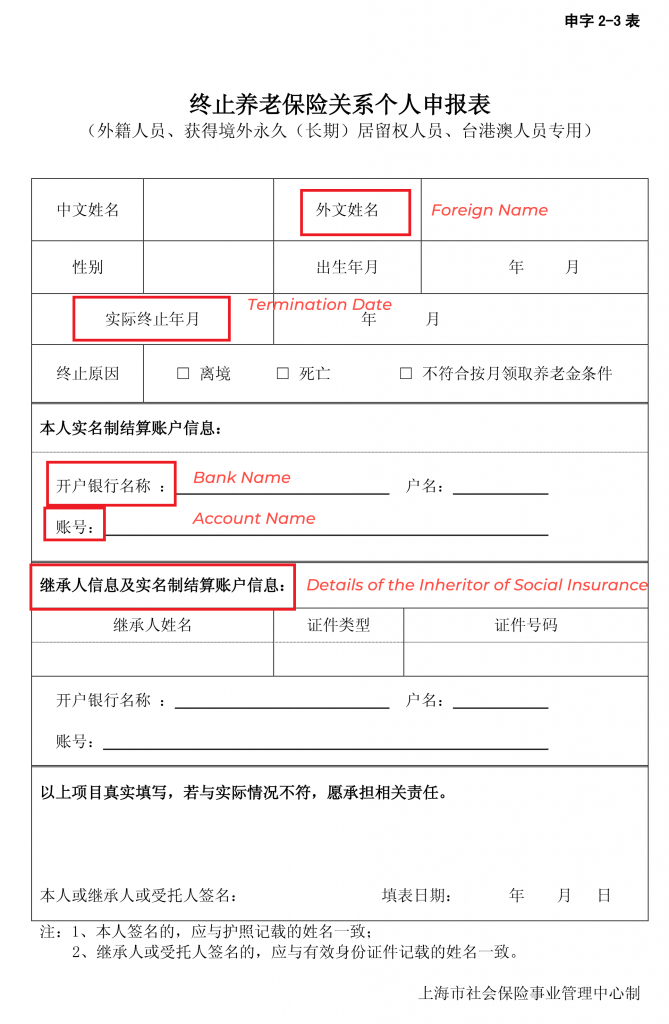

Application form for the termination of social contribution for employee

Meanwhile, a foreigner can also pass on the social insurance (pension and medical) refund to another person as an inheritance in case of death.

A foreigner may directly report to the respective local Human Resources and Social Security department to apply for a pension refund. The following documents are needed for the application:

- Application for the termination of social contribution

- Social security card

- Passport with a valid residence permit

- Proof of the end of the labor contract

Contact us

Our team of local and foreign experts can assist you in matters regarding your tax filing and social insurance refund procedures. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!If you want to know more about doing business in China, contact our team for consultation and assistance. Follow us on social media to get the latest news!

Our experienced team has the necessary expertise and the know-how to support you with your business – have a look at the services we offer.