Most banks are likely to discontinue the LIBOR or London Inter-bank Offered Rate after 2021 and it will become completely obsolete by 2023. Despite LIBOR’s reputation among specialists as the “world’s most important number”, monetary boards are transitioning away from it and finding alternatives instead.

Have a look at our previous article on London Shanghai Stock Connect – What to Expect

The change in the LIBOR, however, should not discourage current and potential borrowers from availing of banks’ services. The different monetary bodies in the world are working together to come up with Alternative Reference Rates (ARRs) for the banking institutions to use.

Significance of LIBOR

Pricing for loans pertains to interest rates which different banks offer one another for making deposits or “interbank offered rates (IBORs)”. The LIBOR has had the leading market for such transactions so it has been widely used. In the early days, loan market banks took deposits in the interbank market to fund their involvement in loans. This, however, required a given particular currency and interest period.

Prime banks consist of the panel of banks that submit interest rates that are then trimmed and averaged. Banks consider these rates as something they could (themselves) offer in the interbank market. This is why LIBOR became a pricing source for a wide range of financial contracts and other commercial arrangements. These days, however, banks do not anymore get their funding from the interbank market. Banks fund their transactions from elsewhere and have been using Interbank Offered Rates (IOR) as a theory, more than actual practice.

In banking practices, the LIBOR is used on different transactions worldwide, such as the benchmark for lenders in identifying interest rates for various debt instruments. Other common uses include:

- Mortgages

- Corporate loans

- Government bonds

- Credit cards

- Derivative instruments (i.e., interest rate swaps and currency swaps)

- Student loans

LIBOR transition

LIBOR transition is the undertaking of the different financial markets to move away from the use of LIBOR. Instead, alternative “risk-free” benchmark rates or RFRs may be used. An RFR is different from IBOR and not as straightforward a process especially in dealing with different currencies. Different countries are proposing the use of different risk-free rates and how these rates are formulated, approved, and administered may differ. Despite these challenges, there has been a dire need to shift away from LIBOR due to scandals and other anomalies that are inherent in the usage of such rates.

During the 2008 liquidity crisis, scandals from the settling of IBORs prompted investigations. In 2012, attempted manipulation of LIBOR had also been thwarted and investigated. As mentioned previously, there was also a shrinking turnover of the interbank money market (bordering on almost non-existence). Because of these limitations of the LIBOR, the Financial Stability Board (FSB) under G20 has established a steering group to settle with financial regulators and other relevant governing bodies throughout the world. They have placed forth a series of recommended benchmarking reforms to augment the reliability and strength of interest rate benchmarks.

Hong Kong banks

Hong Kong is an international financial center and banking hub in Asia. Several transactions over the years that LIBOR had been in use were also applicable in Hong Kong. LIBOR-based assets of the banking sector reached HKD 3,800 billion at the end of 2018. On the other hand, USD LIBOR is the most widely used benchmark rate for various financial contracts including derivative contracts and loans.

However, in Hong Kong, the Hong Kong Interbank Offered Rate (HIBOR) is extensively used in syndicated loans offered to corporations. Moreover, mortgages in Hong Kong commonly use the one-month HIBOR as the benchmark. Since it is a credible financial benchmark reference, no plan to discontinue HIBOR has been declared so far. Although HIBOR will continue as a benchmark reference, Hong Kong must still be prepared for the phasing-out of LIBOR. Among the preparations that have been issued is the identification of HKD Overnight Index Average (HONIA) which market participants are free to choose either HONIA or HIBOR.

Recommendations for Hong Kong banks

Hong Kong is obligated to follow these recommendations, including recognizing an alternative reference rate (ARR) for HIBOR:

- ARRs serve as a fallback in case the existing interbank offered rates are no longer regarded as reliable benchmarks. ARRs should be near risk-free overnight interest rates derived from the actual transaction (as recommended by FSB).

- Proposed ARR for HIBOR: Hong Kong Dollar Overnight Index Average (HONIA) which is based solely on transaction data and does not have longer tenors (e.g., one-month or three-month rates only) as it is only a benchmark overnight rate.

- The Hong Kong Monetary Authority (HKMA) has since encouraged market participants to start exploring how to incorporate HONIA into their businesses, to help reduce the market impact if ever HIBOR was discontinued.

- The FSB also agrees that interbank offered rates can continue to be used, provided they are considered reliable by local market participants and regulators

Interest rate benchmark reforms are complex but important. All financial institutions must ensure to oversee preparatory work for the transition. The HKMA had issued a letter to Hong Kong banks in early March of 2019 specifying that banks should undertake adequate preparation. These activities include:

- Measuring, quantifying, and monitoring affected exposures;

- Identifying and assessing key risks;

- Formulating action plans; and

- Closely monitoring benchmark rate reforms in Hong Kong and elsewhere.

Transition milestones for Hong Kong banks

Authorized institutions need to endeavor to achieve key transition milestones that the HKMA (in consultation with the Treasury Markets Association) developed. This is with regards to the transition from LIBOR to Alternative Reference Rates (ARR).

- Authorized institutions should be in a position to offer products referencing the LIBOR ARRs from January 1, 2021.

- Adequate fallback provisions should be included in all newly issued LIBOR-linked contracts that will mature after 2021; and

- Institutions authorized to use LIBOR in their products (in the past) should cease to issue new LIBOR-linked products that will mature after 2021 by June 30, 2021.

Requirement of prompt action

Contracts that make use of LIBOR benchmarking rates may be subjected to legal disputes if institutions and companies do not reach an agreement with their banks and/or counterparts on a replacement rate before LIBOR becomes unavailable.

Most existing LIBOR contracts do not contain stipulations regarding contract management if LIBOR is permanently discontinued. Therefore, prompt action to assess the implications of LIBOR discontinuation is necessary. It also helps to seek out professional advice and engage banking facilities to make timely preparations for the transition.

Identifying and reviewing all existing contracts that use LIBOR benchmarking rate is imperative. Companies should revisit all loans, derivatives, floating-rate notes, and other items in case LIBOR becomes permanently unavailable. If these contracts do not contain related provisions, companies should consult with their banks and counterparts to settle in an alternative reference rate to fall back upon. Moreover, avoidance of entering into new LIBOR-based contracts that mature beyond 2021 is necessary as well.

Alternatives to LIBOR

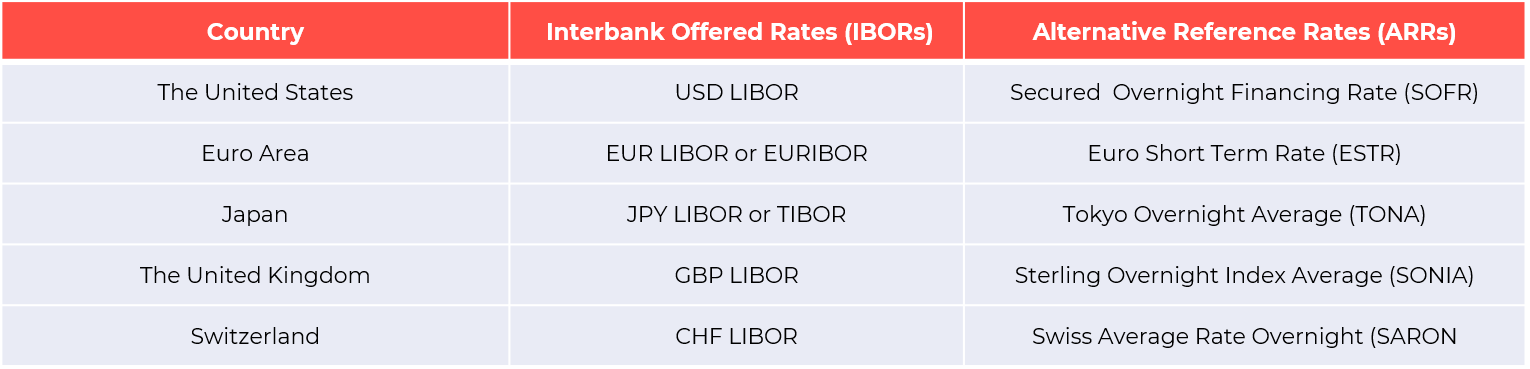

There are five LIBOR currency areas: the United States, Euro Area, Japan, the United Kingdom, and Switzerland. Relevant governing bodies of the respective countries have identified transaction-based overnight interest rates that may be used as an alternative to the use of LIBOR:

By using simple or compounded averaging (or compounding in arrears), the interest rates based on these overnight rates may be derived.

Conclusion

In light of LIBOR’s discontinuation, countries around the world, including Hong Kong have made preparations for alternative reference rates that will be used in various banking transactions. Monetary boards are coming up with ways on how to transition away from it, yet the process is ongoing. Despite that, concerned parties have not seen setbacks yet because acceptable rates are available for use. The most important aspect for corporates and banking institutions to focus on for now is to review contracts that may be affected by the discontinuation of LIBOR. They also have to make sure alternative rates are settled between the parties involved. Also, keeping up with the timeline of important milestones in the transition must be observed to prepare for future difficulties that may arise.

Contact us

S.J. Grand provides advisory on setting up a business in Mainland China and Hong Kong. We put our competent team at your service to give you the most effective market entry, due diligence, and tax optimization strategy for foreign-invested enterprises. Contact us to get you started.

Moreover, we have been at the forefront of promoting full automation of business operations, especially for startups and SMEs. We have introduced our Cloud-based advanced solution, Kwikdroid, to make business transactions easier with us, no matter what type or size of the company. Visit our Kwikdroid page to learn more about the services we offer.

You may be interested to read about how to manage your company remotely using the advantages of Kwikdroid. Check it out!