Hong Kong’s amended Foreign Source Income Exemption (“FSIE”) regime, which comes into effect in 2023, has been making waves in the business community. The new regime aligned with EU rules will allow qualifying MNE groups to enjoy a tax exemption on certain categories of foreign-sourced income.

Read our previous post Hong Kong: A Proven Gateway to Mainland China

What changed?

In the past, offshore passive income received by multinational companies with no substantial economic presence in the region, were not subject to profits tax. Some of these companies enjoyed “double non-taxation”, which means that they didn’t pay taxes neither in Hong Kong, nor in the jurisdiction where the profits were generated. Considered to be a non-cooperative jurisdiction for tax purposes in 2021, Hong Kong was placed on the EU’s watchlist.

The new FSIE regime establishes that MNE entities will no longer be able to enjoy double non-taxation in respect of specified foreign-sourced income. Individuals and local companies that do not belong to a multinational group are exempt of the FSIE regime.

Learn about our Tax Expertise

The FSIE Exemption Regime

The FSIE scheme is a tax exemption that grants relief for foreign-sourced income that has already been subject to tax in a foreign jurisdiction. The amended regime introduces several changes that affect the eligibility, scope, and calculation of the exemption. To qualify for the exemption, taxpayers must meet certain criteria, such as having an office or other establishment in Hong Kong, and the income in question must not have arisen from a Hong Kong business operation.

Four types of offshore passive income that are subject to the FSIE Exemptions scheme:

- Dividends;

- Disposal gains in relation to shares or equity interest;

- Interest income; and

- Income derived from Intellectual Property (IP).

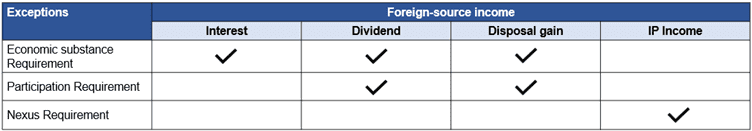

To benefit from FSIE regime exceptions you need to comply with the following requirements:

- Economic substance requirement (ESR)

This requirement pertains to having substantial economic activities conducted in Hong Kong that are directly related to the income-generating activity. In other words, the taxpayer must demonstrate that there is a genuine business presence and economic substance in Hong Kong.

- Participation Requirement

This requirement involves having sufficient participation in the offshore entity that generates the income. The taxpayer needs to prove that they have a significant level of ownership (over 25%) or control over the entity generating the foreign income.

- Nexus Requirement

The nexus requirement is met if the taxpayer can establish a clear and substantial connection between the foreign IP income and their operations and R&D activities in Hong Kong.

Learn about our Incorporation Services

Pure equity-holding versus non-pure equity-holding entities

The key requirement for pure equity-holding entities is the level of ownership or control over the offshore entity generating the income. The Hong Kong entity must demonstrate substantial ownership or control over the offshore entity, which typically involves owning a certain percentage of shares or having significant influence in decision-making.

For non-pure equity-holding entities, meeting the Economic Substance Requirements (ESR) becomes more important. These entities need to show substantial economic activities conducted in Hong Kong that are directly related to the income-generating activities.

Steps you can take today

To maximize the benefits of the FSIE regime, businesses should consider reevaluating their global tax strategies and possibly restructuring their Hong Kong operations to take advantage of the scheme. Companies looking to expand their operations should investigate how establishing a presence in Hong Kong could help optimize their tax position under the amended FSIE regime. Employing experienced accounting and tax advisors can also be instrumental in maximizing the tax benefits of the new regime.

S.J. Grand Financial and Tax Advisory assists foreign firms in navigating the complexities of operations and investments in Greater China since 2003. For more information contact us at contact@sjgrand.cn.

S.J. Grand is a full service accounting firm focused on serving foreign-invested enterprises in Greater China. We help our clients improve performance, value creation and long-term growth.

Other Articles: